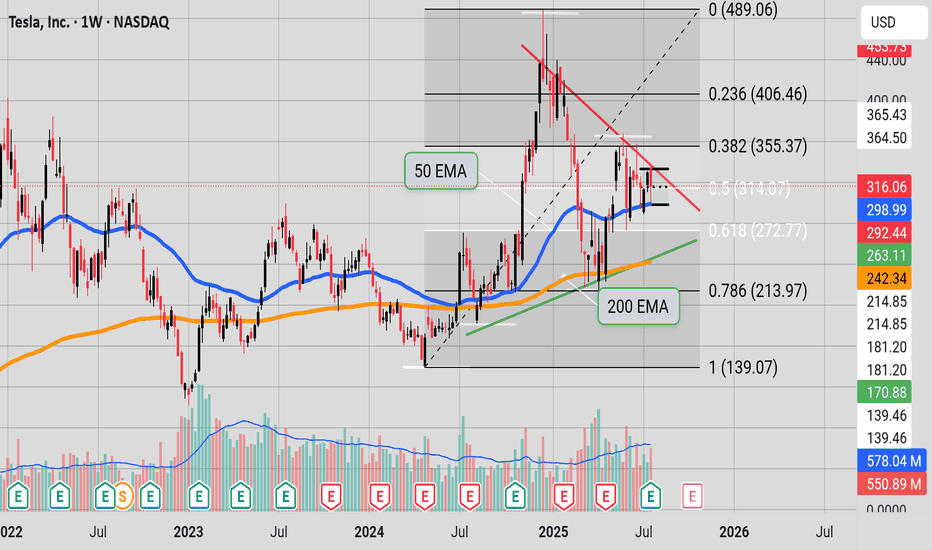

Inflection point"Tesla is at a binary point on the chart. The stock is wedged tightly between the red, downward-sloping resistance line (upper boundary) and the green, upward-sloping support line (lower boundary)—the classic apex of an asymmetrical triangle.

At this stage:

A breakout above the red resistance woul

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

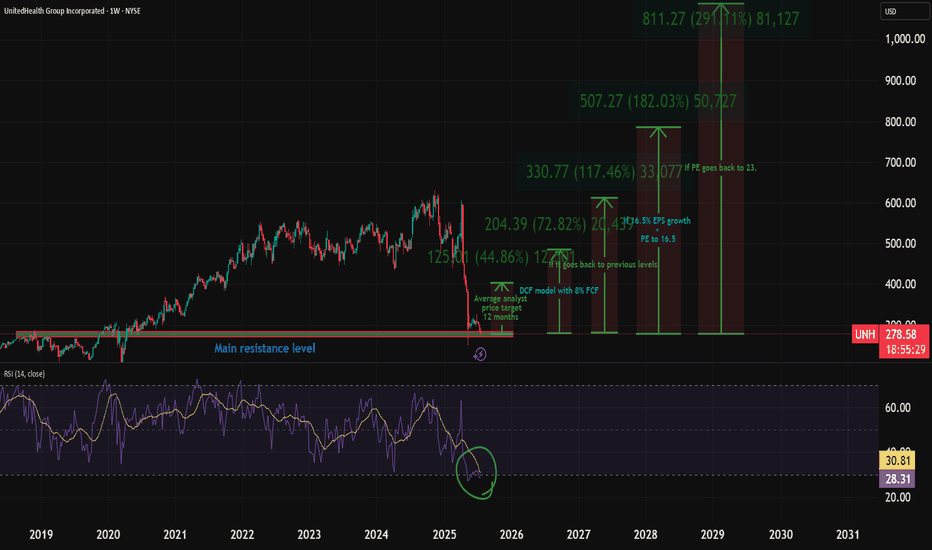

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) ea

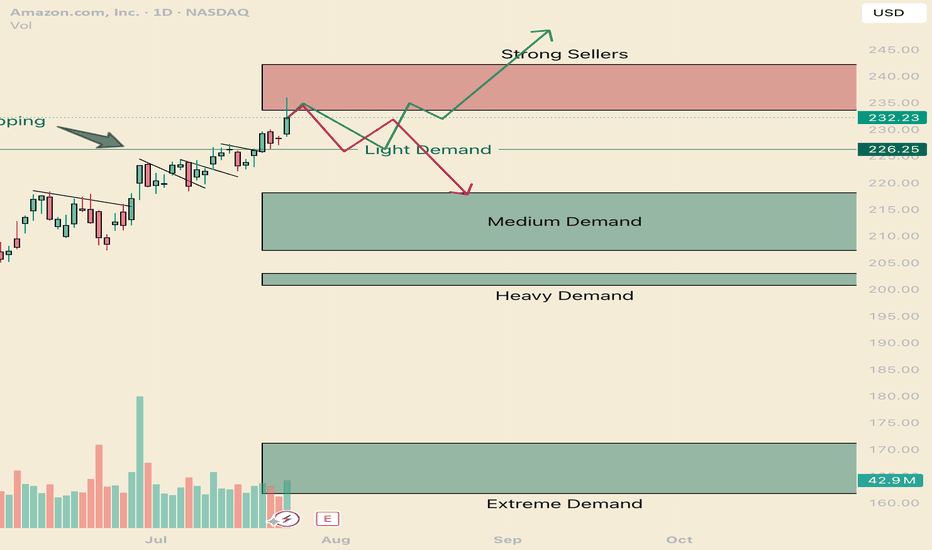

How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers

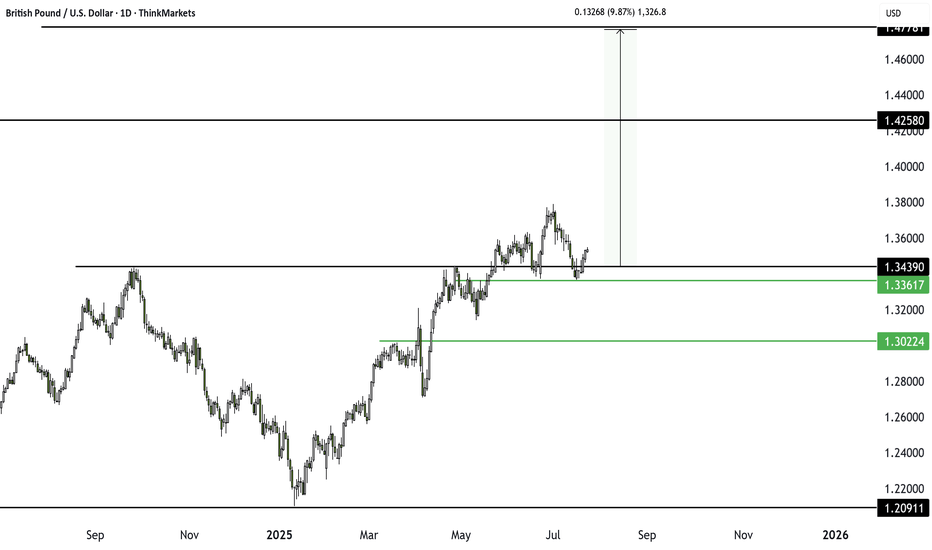

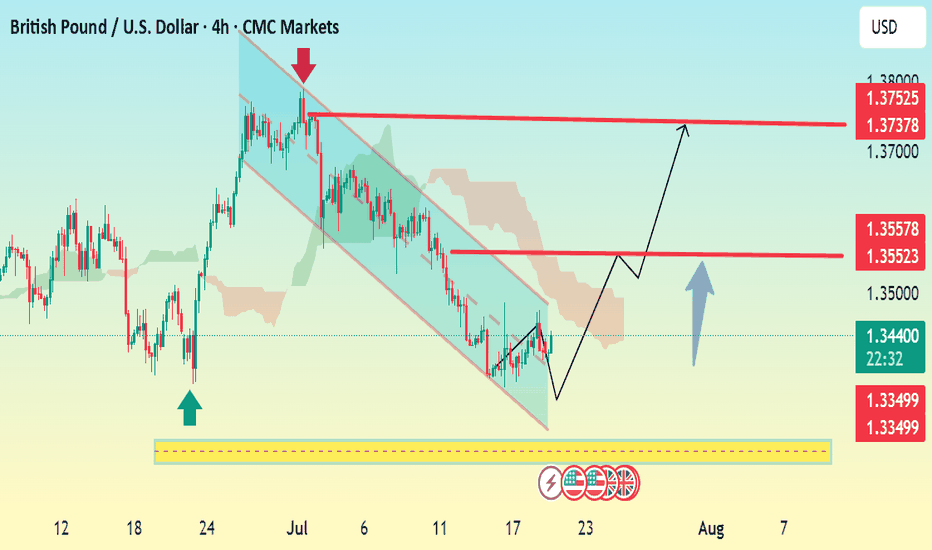

GBPUSD Traders Beware: A Major Drop Could Be ComingThe classic rule says what doesn’t go up must come down. After a failed breakout at 1.3439, GBPUSD is struggling. With longs sitting on big gains from January’s low, a drop toward 1.3361 or even lower looks likely. Watch this key level now.

This content is not directed to residents of the EU or

TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prio

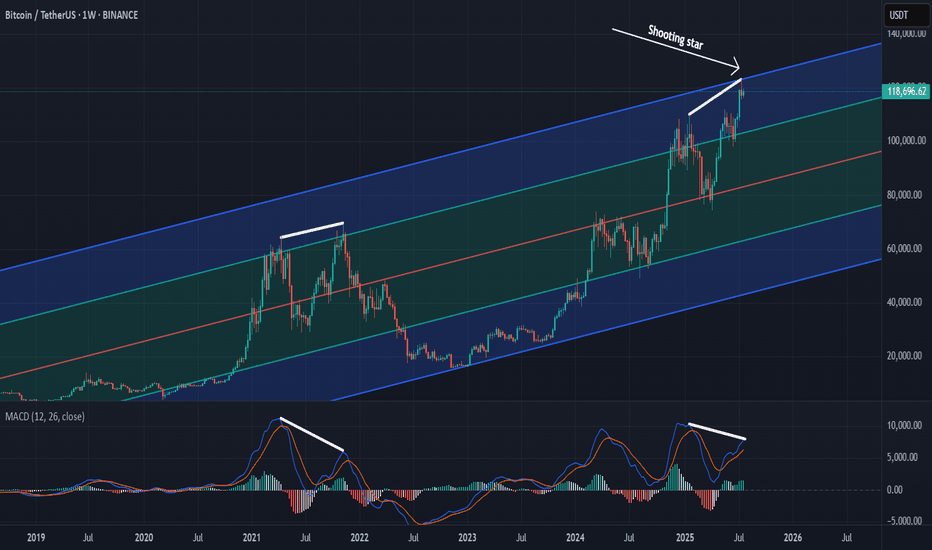

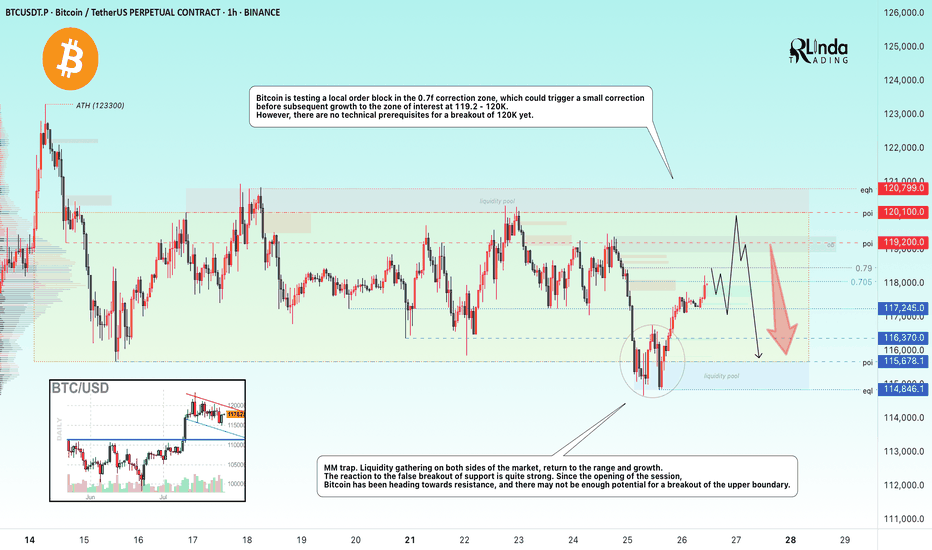

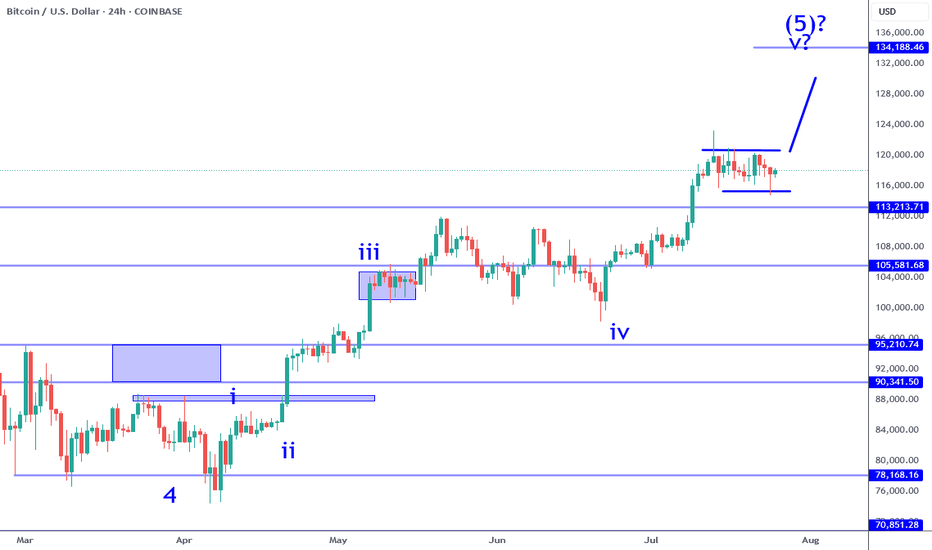

Calling the Unthinkable: Why a Bitcoin Drop May Be ComingCOINBASE:BTCUSD BITSTAMP:BTCUSD OKX:BTCUSD BINANCE:BTCUSDT.P

Predicting a drop in Bitcoin's price during a strong uptrend is extremely difficult and calling it takes real courage. It puts my credibility at risk, but based on everything I see, I believe BTC has reached dangerously high levels

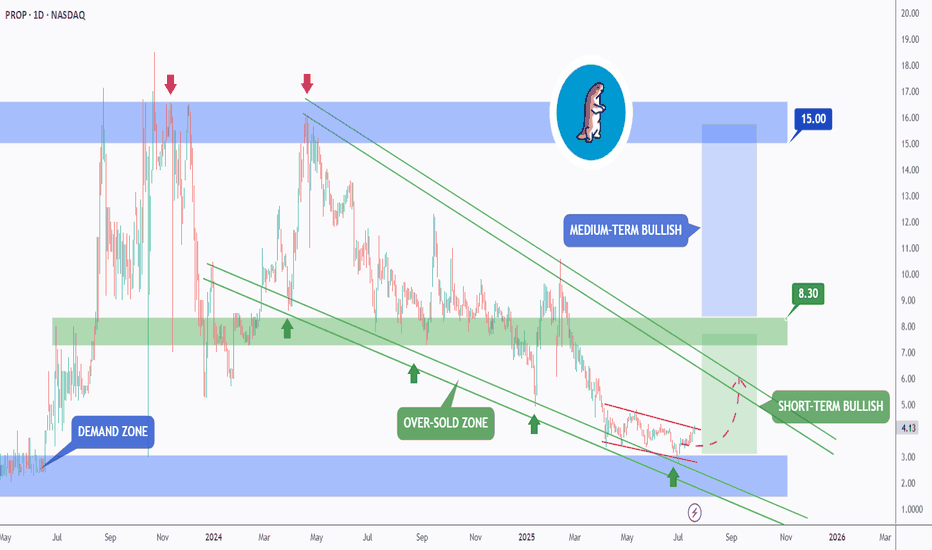

A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scal

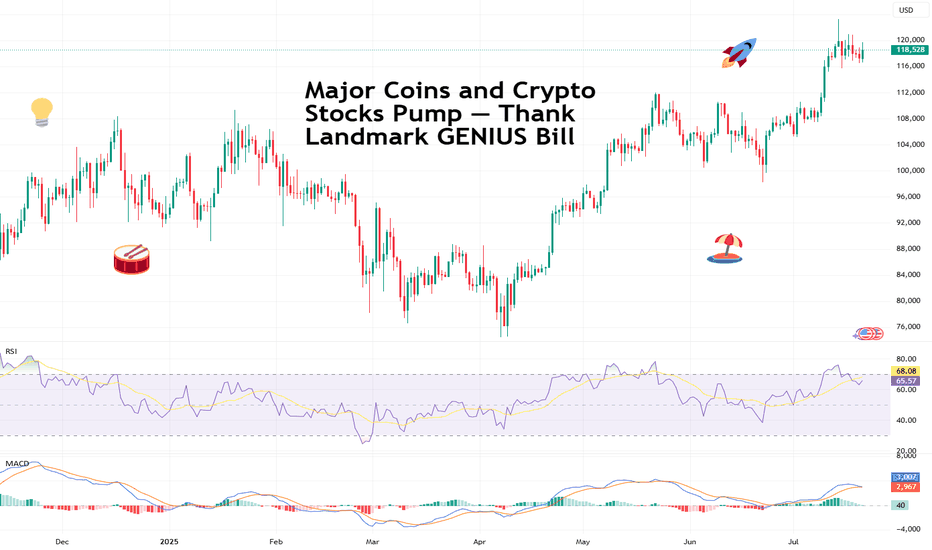

Major Coins and Crypto Stocks Pump — Thank Landmark GENIUS BillBitcoin BITSTAMP:BTCUSD making ATHs? Old news. But Coinbase NASDAQ:COIN and Robinhood NASDAQ:HOOD hitting those record-high notes? And XRP BITSTAMP:XRPUSD dangerously close to eclipsing its own peak, while Ethereum keeps chugging along toward $4,000? Now we’re talking.

In a market-friendl

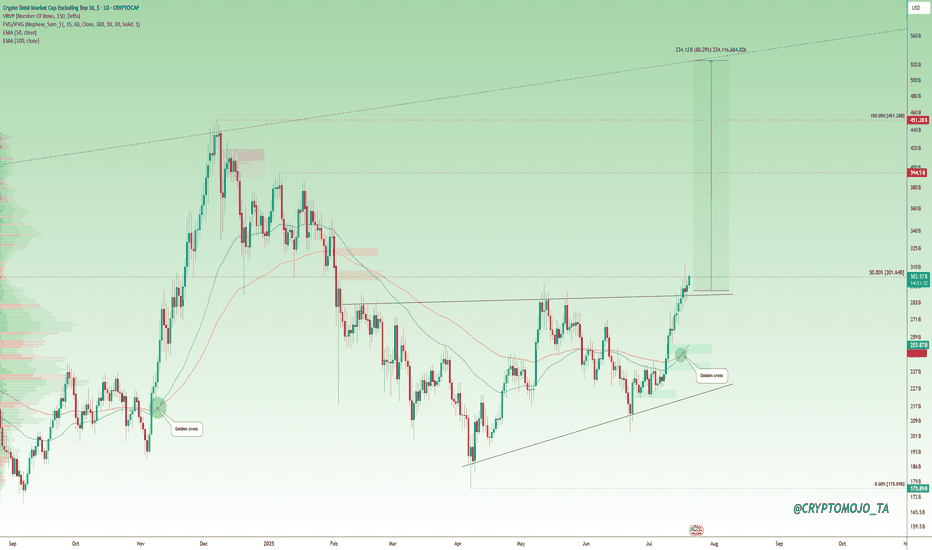

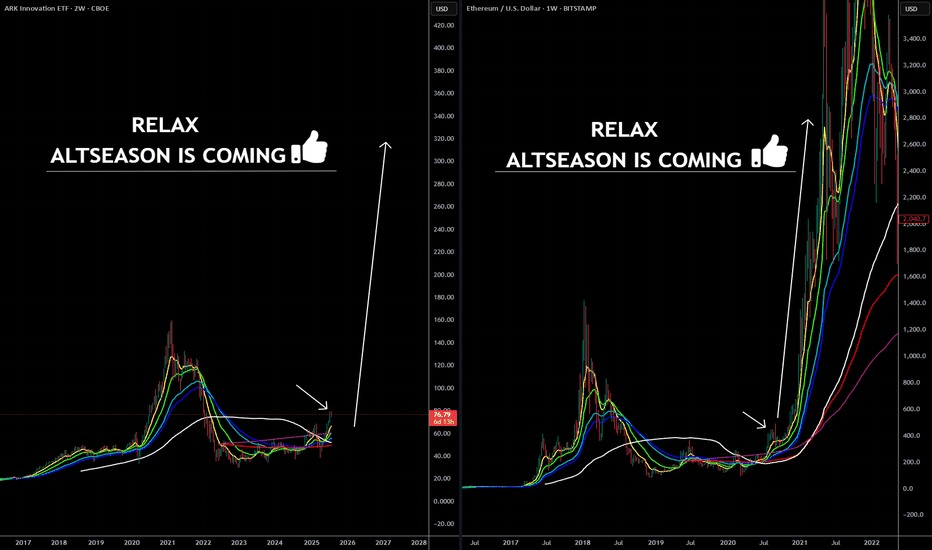

Altcoins Waking Up? Here’s What the Charts Are Telling Us!Altcoin Watch: Momentum Is Building!

A major shift is unfolding in the OTHERS chart, it just broke above its previous high and is on track to form a golden cross, a strong technical signal that often leads to a rally.

But here's the key: a confirmed breakout needs a solid close above the 50% retra

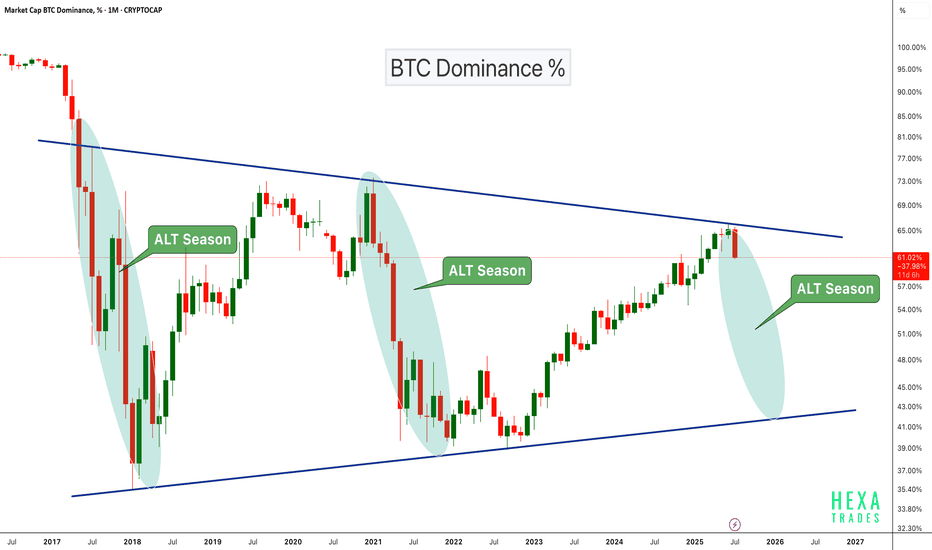

Altseason Loading?BTC Dominance chart has once again respected the long-term descending trendline resistance, showing a sharp monthly rejection. Historically, similar rejections have marked the beginning of ALT seasons, where capital flows out of Bitcoin into altcoins, boosting their performance significantly.

Chart

See all editors' picks ideas

Fair Value MSThis indicator introduces rigid rules to familiar concepts to better capture and visualize Market Structure and Areas of Support and Resistance in a way that is both rule-based and reactive to market movements.

Typical "Market Structure" or "Zig-Zag" methods determine swing points based on fixed t

Risk Distribution HistogramStatistical risk visualization and analysis tool for any ticker 📊

The Risk Distribution Histogram visualizes the statistical distribution of different risk metrics for any financial instrument. It converts risk data into histograms with quartile-based color coding, so that traders can understand th

Crowding model ║ BullVision🔬 Overview

The Crypto Crowding Model Pro is a sophisticated analytical tool designed to visualize and quantify market conditions across multiple cryptocurrencies. By leveraging Relative Strength Index (RSI) and Z-score calculations, this indicator provides traders with an intuitive and detailed sn

Dynamic Gap Probability ToolDynamic Gap Probability Tool measures the percentage gap between price and a chosen moving average, then analyzes your chart history to estimate the likelihood of the next candle moving up or down. It dynamically adjusts its sample size to ensure statistical robustness while focusing on the exact de

EVaR Indicator and Position SizingThe Problem:

Financial markets consistently show "fat-tailed" distributions where extreme events occur with higher frequency than predicted by normal distributions (Gaussian or even log-normal). These fat tails manifest in sudden price crashes, volatility spikes, and black swan events that traditi

Divergence Screener [Trendoscope®]🎲Overview

The Divergence Screener is a powerful TradingView indicator designed to detect and visualize bullish and bearish divergences, including hidden divergences, between price action and a user-selected oscillator. Built with flexibility in mind, it allows traders to customize the oscillator

Logarithmic Moving Average (LMA) [QuantAlgo]🟢 Overview

The Logarithmic Moving Average (LMA) uses advanced logarithmic weighting to create a dynamic trend-following indicator that prioritizes recent price action while maintaining statistical significance. Unlike traditional moving averages that use linear or exponential weights, this indic

Volumatic Support/Resistance Levels [BigBeluga]🔵 OVERVIEW

A smart volume-powered tool for identifying key support and resistance zones—enhanced with real-time volume histogram fills and high-volume markers.

Volumatic Support/Resistance Levels detects structural levels from swing highs and lows, and wraps them in dynamic histograms that re

True Close – Institutional Trading Sessions (Zeiierman)█ Overview

True Close – Institutional Trading Sessions (Zeiierman) is a professional-grade session mapping tool designed to help traders align with how institutions perceive the market’s true close. Unlike the textbook “daily close” used by retail traders, institutional desks often anchor their

See all indicators and strategies

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

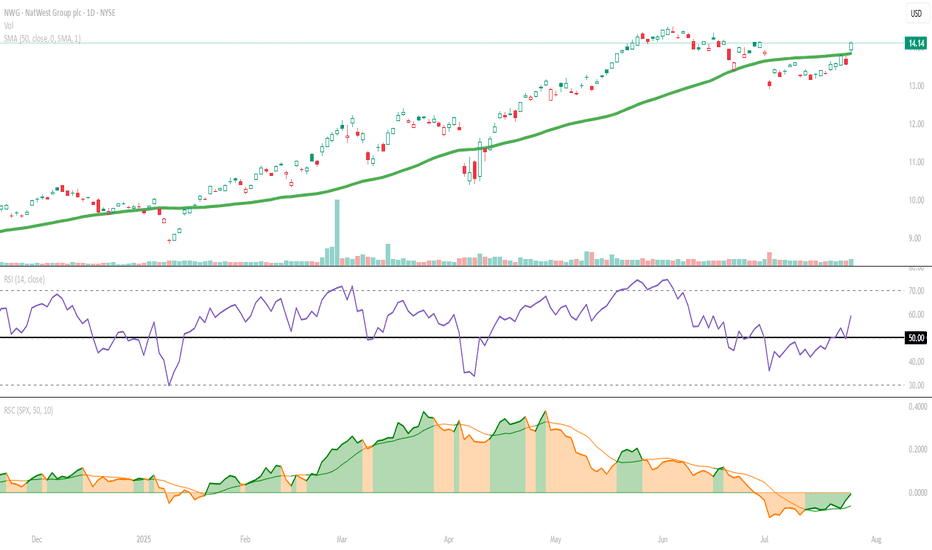

NatWest Group (NWG): A Kicker Setup Is BrewingKicker-like Surge Shifts Tone

The latest daily candle resembles a bullish kicker, gapping above the previous day's range with strong follow-through—a possible sign of sentiment shift. Notably, this move came with an RSI jump from the equilibrium zone of 50 to near 60, suggesting growing momentum. P

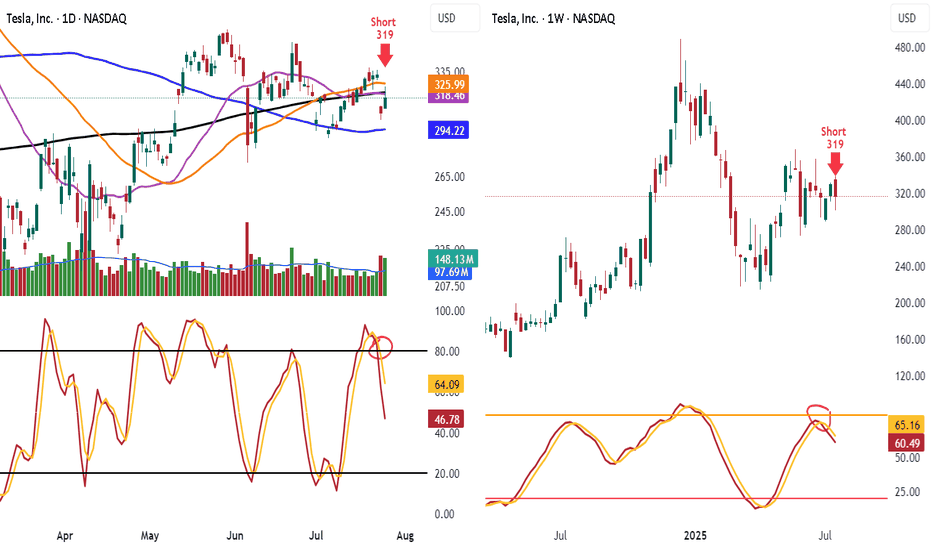

Inflection point"Tesla is at a binary point on the chart. The stock is wedged tightly between the red, downward-sloping resistance line (upper boundary) and the green, upward-sloping support line (lower boundary)—the classic apex of an asymmetrical triangle.

At this stage:

A breakout above the red resistance woul

Shorted TSLA 319 Look at TSLA hit 50 day and 200 day MA and failed and know under them

Look at the lower highs and see the stoch heading down

Know lets look weekly stoch heading down and lower highs

Target is 100 day ma 294.22 take some off. When it breaks will add back on

Have trailing stop in place

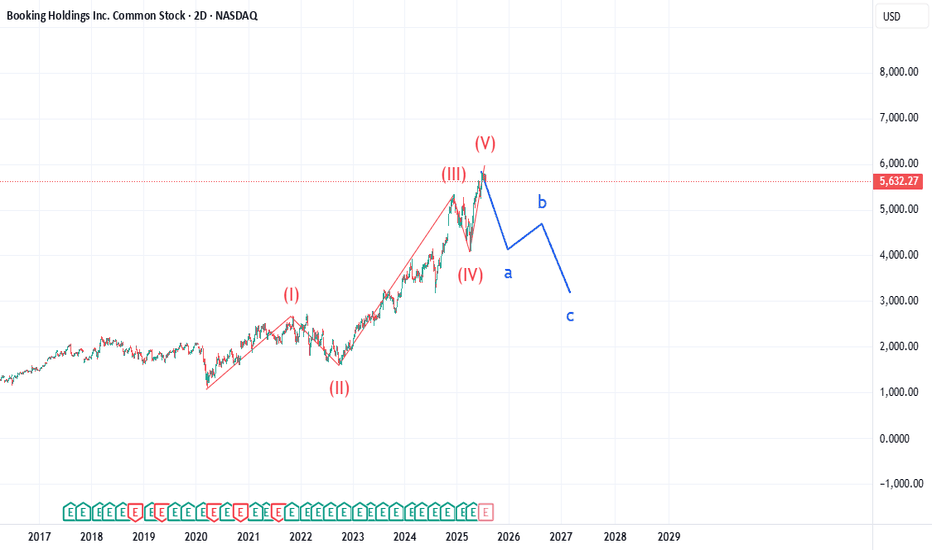

BKNG: Catalyst for the drop - EarningsBKNG has completed a super cycle 5 wave structure beginning at the completion of the March 2020 COVID drop. First target is 4030 by EOY to early next year. Many other stocks are showing a similar structure, so expecting selling volume to greatly increase over the next 90 days.

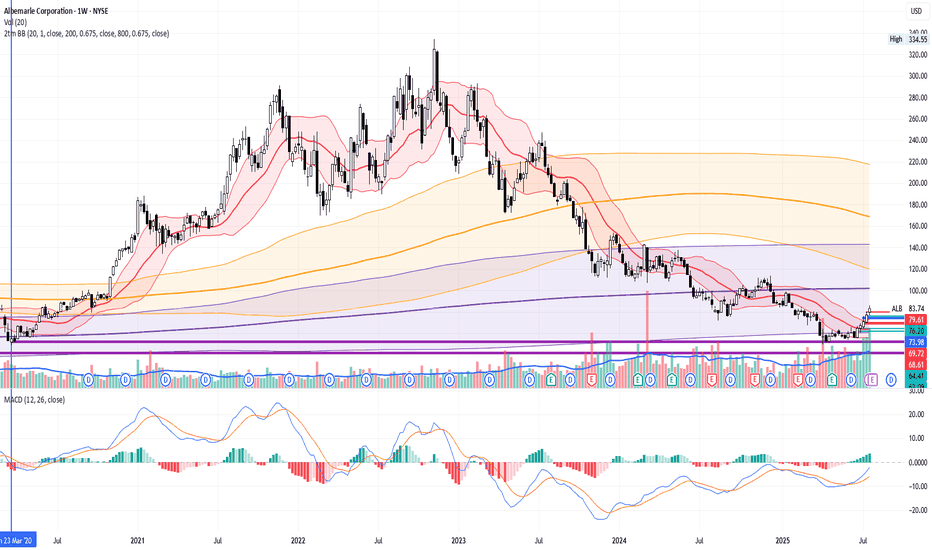

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is qui

How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers

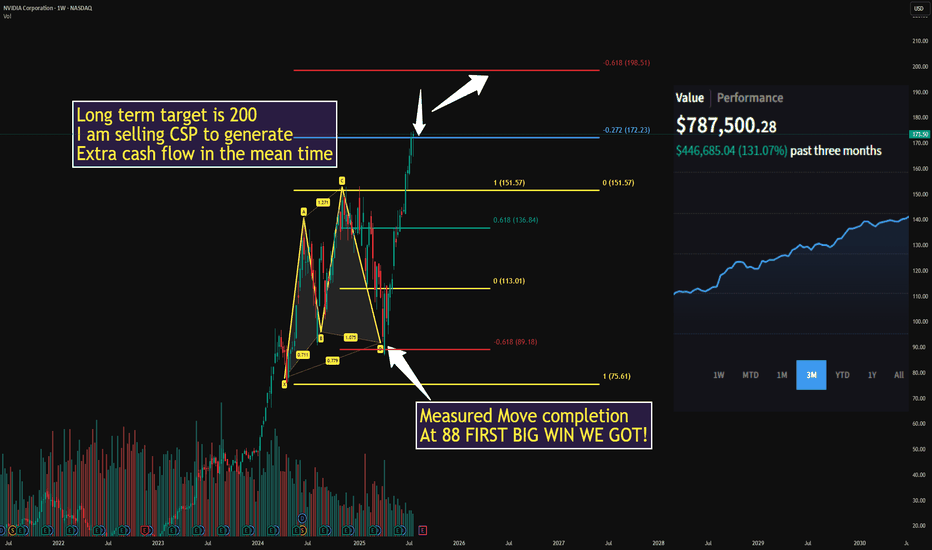

99% of people buying $NVDA don't understand this:🚨99% of people buying NASDAQ:NVDA don't understand this:

NASDAQ:GOOGL : “We’re boosting AI capex by $10B.”

Wall Street: “Cool, that’s like $1B or 0.06 per share for $NVDA.”

So from $170.50 at the time of news to $170.56 right?

No.

NASDAQ:NVDA trades at 98× earnings. So that $0.06? Turns in

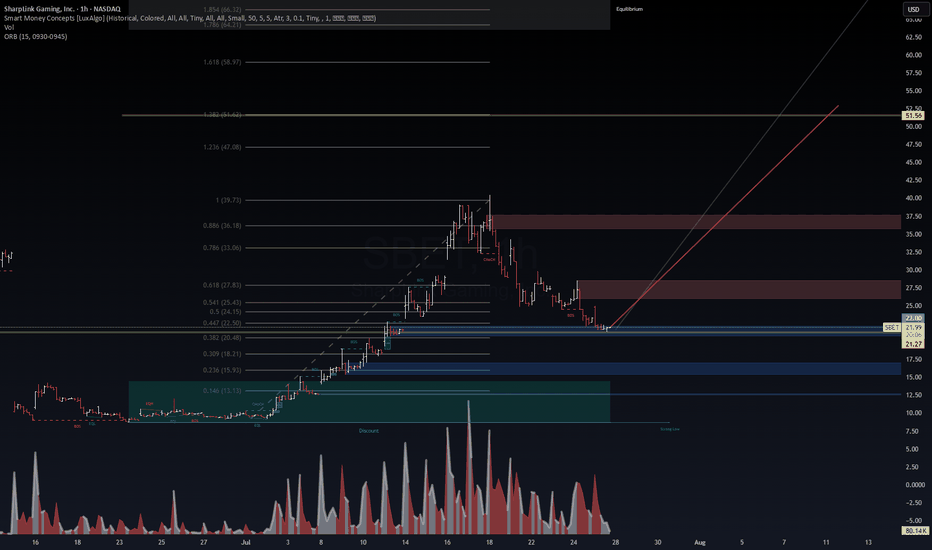

SBET – Holding the Key Zone for a Potential SqueezeSBET – Holding the Key Zone for a Potential Squeeze 🚀🔥

SBET is sitting at a critical support zone (21.0–21.3), right inside the 0.382 Fibonacci retracement. VolanX signals accumulation as volume cools down, setting up for a possible next leg higher.

Key Levels to Watch

Support: 21.0 – 21.3 (Fib 0.

See all stocks ideas

Tomorrow

EPDEnterprise Products Partners L.P.

Actual

—

Estimate

0.64

USD

Tomorrow

RVTYRevvity, Inc.

Actual

—

Estimate

1.14

USD

Tomorrow

ARLPAlliance Resource Partners, L.P.

Actual

—

Estimate

0.61

USD

Tomorrow

TLRYTilray Brands, Inc.

Actual

—

Estimate

−0.02

USD

Tomorrow

NBNNortheast Bank

Actual

—

Estimate

2.57

USD

Tomorrow

ULBIUltralife Corporation

Actual

—

Estimate

0.13

USD

Tomorrow

ERIEErie Indemnity Company

Actual

—

Estimate

3.48

USD

Tomorrow

PRKPark National Corporation

Actual

—

Estimate

2.45

USD

See more events

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

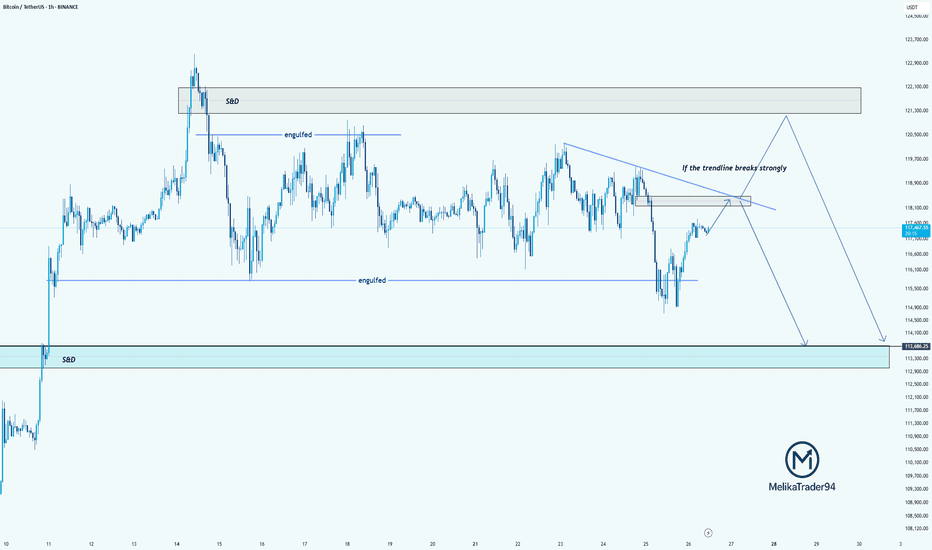

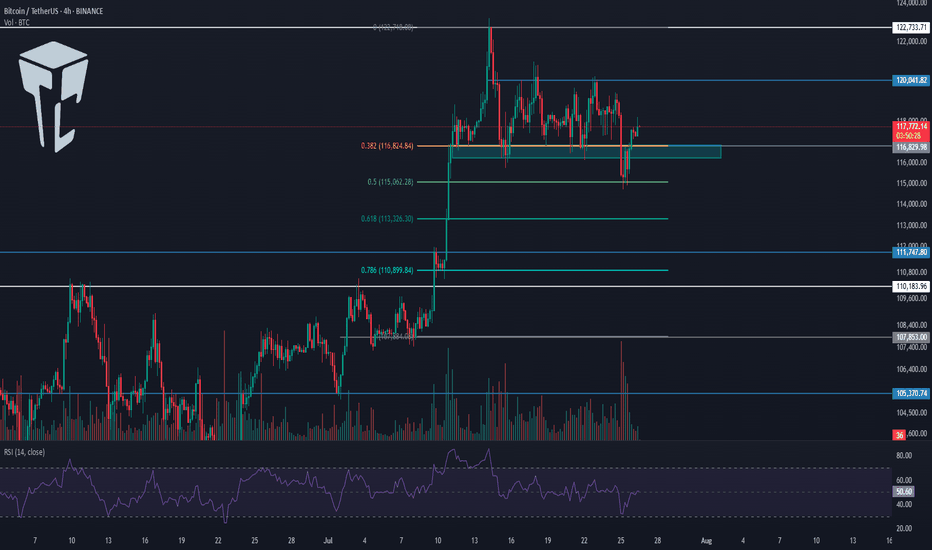

TC Analysis – Watching That Trendline Closely!Hello guys!

Bitcoin is currently approaching a key decision point. As highlighted on the chart, we’ve got a descending trendline acting as strong resistance. If this trendline breaks with strength, we may see price push up into the supply & demand zone around 121,000–122,000 before potentially reve

BITCOIN → Correction within a downward channel. 112K or 125K?BINANCE:BTCUSDT is consolidating. However, a local downward trading range is forming relative to the current setup. What is the probability of a correction continuing to 112K or growth to 125K?

Daily structure: a local correctional channel within a global bullish trend. We have cascading resis

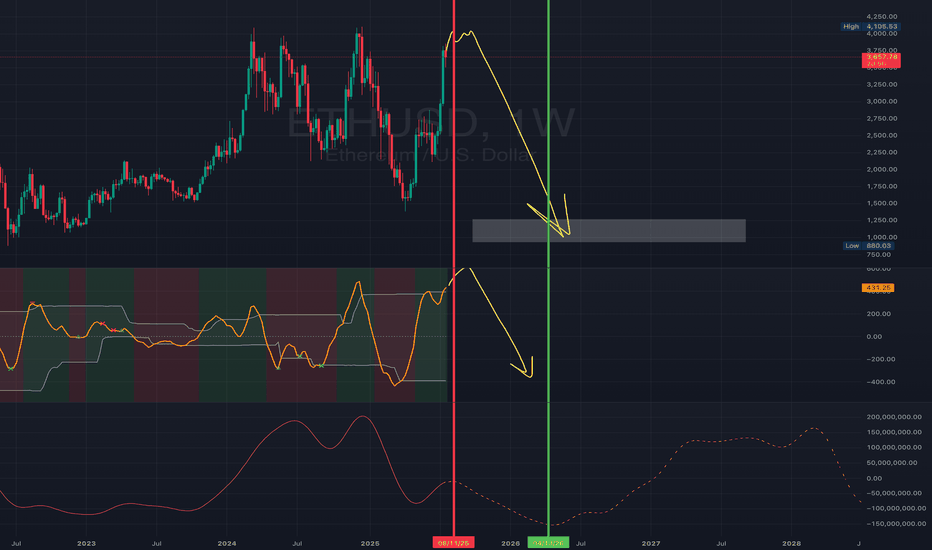

THE END OF ETHI think they’re about to trap all of you in the most popular alts.

Bitcoin. Ethereum. XRP. Solana. ADA. DOGE. PEPE. You name it.

The end of ETH is near.

🟩 Green = I’m buying

🟥 Red = I’m selling

Last time we predicted the drop from $4,000 to $1,400.

This time I want to see ETH under $1,000.

Good

SHIB Market Cap – Dip Before the Rip?Hey Traders!

🧠 Idea: After a strong bounce from recent lows, SHIB’s market cap is showing signs of consolidation. A minor dip could come first, but if support holds, the next move may be a solid push upward.

📌 Tip of the Day:

Smart pullbacks often precede significant breakouts. Be patient and let

ARKK: The Calm Before the Innovation Storm -ALTSEASON Is COMING🚀 ARKK: The Calm Before the Innovation Storm 🌪️

The markets are shifting, and disruption is about to go vertical. ARK Innovation ETF (ARKK) is quietly positioning itself for what could be the most explosive move of this decade. With high-conviction bets in AI, Bitcoin, genomics, and next-gen tech, t

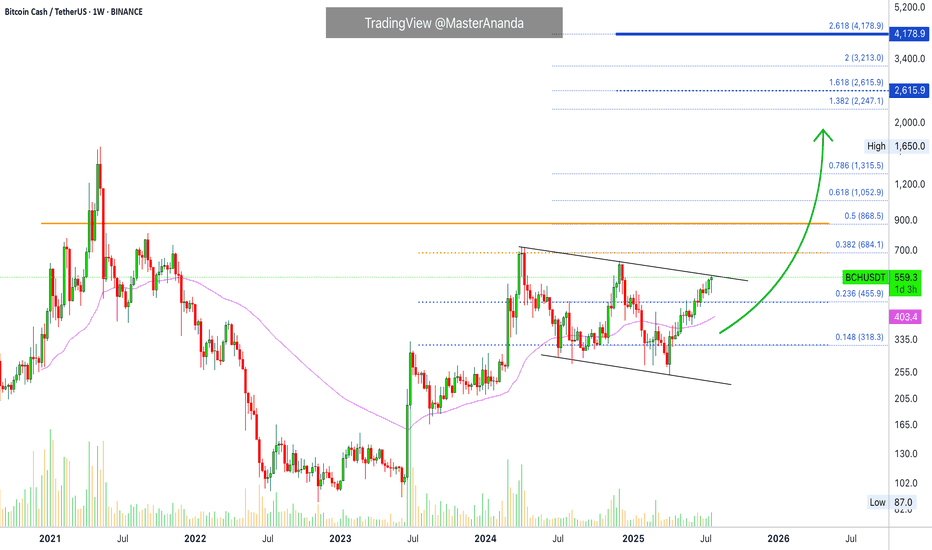

Bitcoin Cash $2,615 Minimum · $4,178 Possible · Plan Ahead105 days. This is definitely the longest stretch of bullish action since 2021. Bitcoin Cash has been growing non-stop for 105 days.

If someone told you this would be the case some months ago or a few years back you wouldn't believe it. What if someone tells you now that you've seen nothing yet? Wha

TradeCityPro | Bitcoin Daily Analysis #137👋 Welcome to TradeCity Pro!

Let’s go over the Bitcoin analysis. I’m making a change to how I analyze Bitcoin — I will no longer include indicators like dominance charts.

🔍 From now on, I’ll be analyzing Bitcoin in daily, 4-hour, and 1-hour timeframes only.

📅 Daily Timeframe

On the daily timefram

SUI - Just one step away from the explosion!The last candle on the daily chart just confirmed a BOS (Break of Structure) — a clear and strong sign of bullish continuation for the asset.

✅ This is a textbook entry for a long position.

🎯 Next target: $5 — and so far, no bearish signs in sight.

Best regards,

Ceciliones 🎯

Bitcoin Still Consolidating For Wave 5 RallyBitcoin sub wave 4 consolidation continues to persist. While there was a failed break out over the previous week, it has not changed the bullish impulse at all. The current structure implies that there is a higher probability that one more leg higher (sub wave 5) is likely. It could be the coming we

See all crypto ideas

News didn't load

Looks like that didn't go very well. Let's try again.

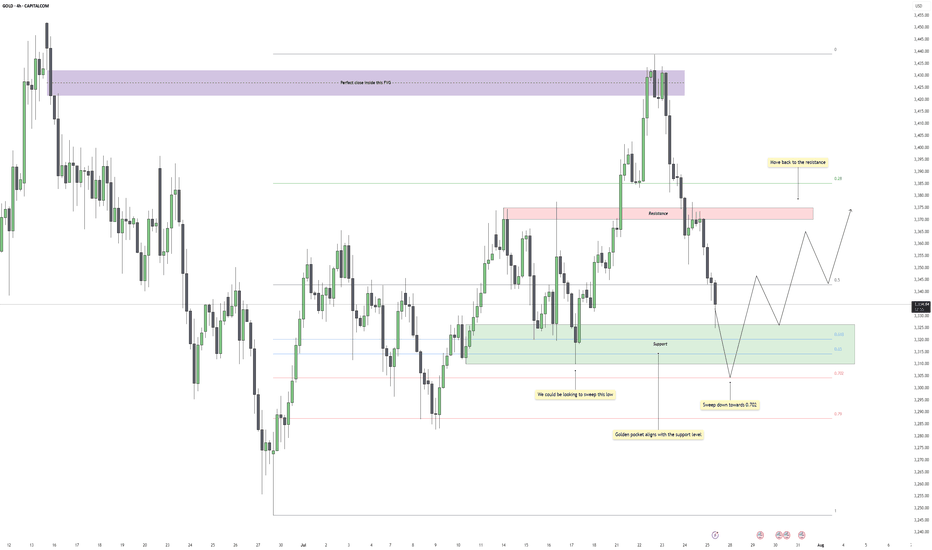

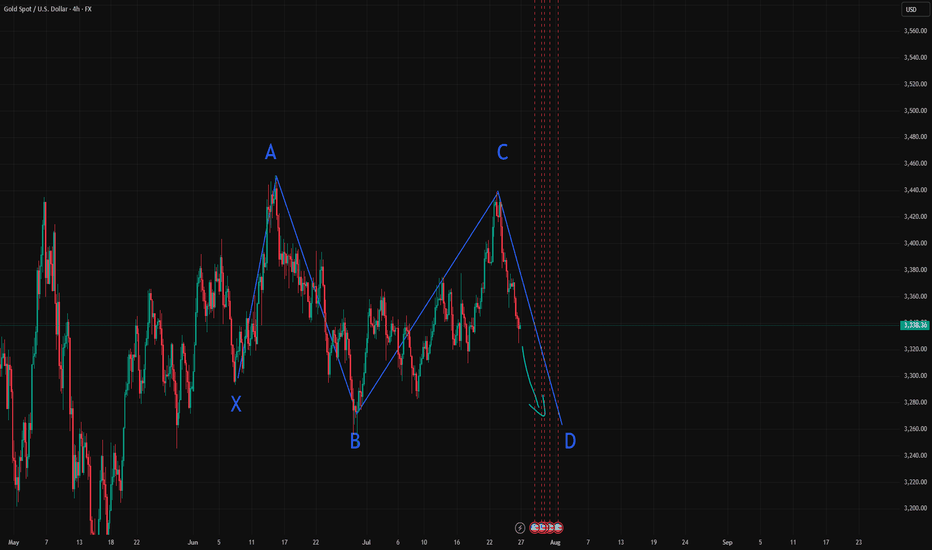

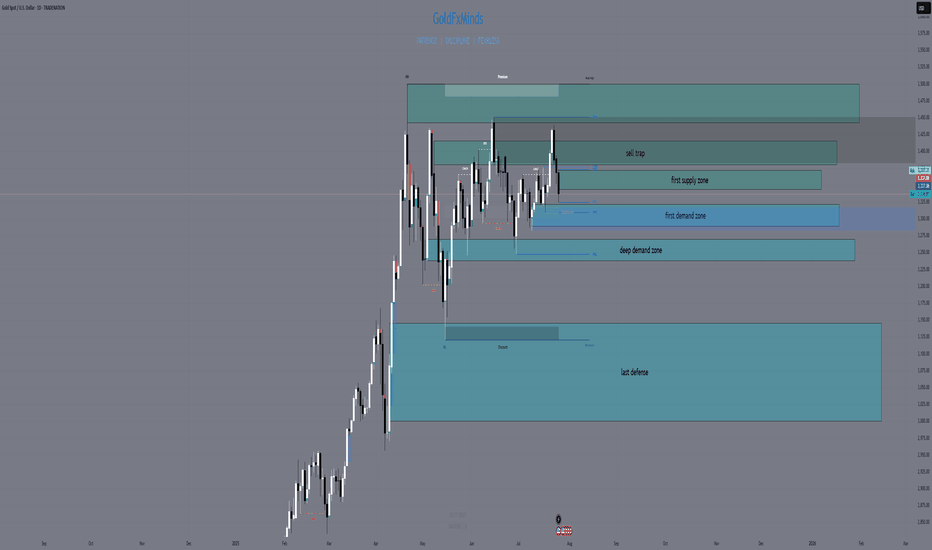

Gold - Eyes on the Final Flush Before ReclaimGold recently dropped after reacting perfectly inside a higher time frame fair value gap. That zone acted as clean supply, offering a precise close within the imbalance and initiating a strong bearish leg. The move confirmed that buyers were overwhelmed at that level, and price began its descent bac

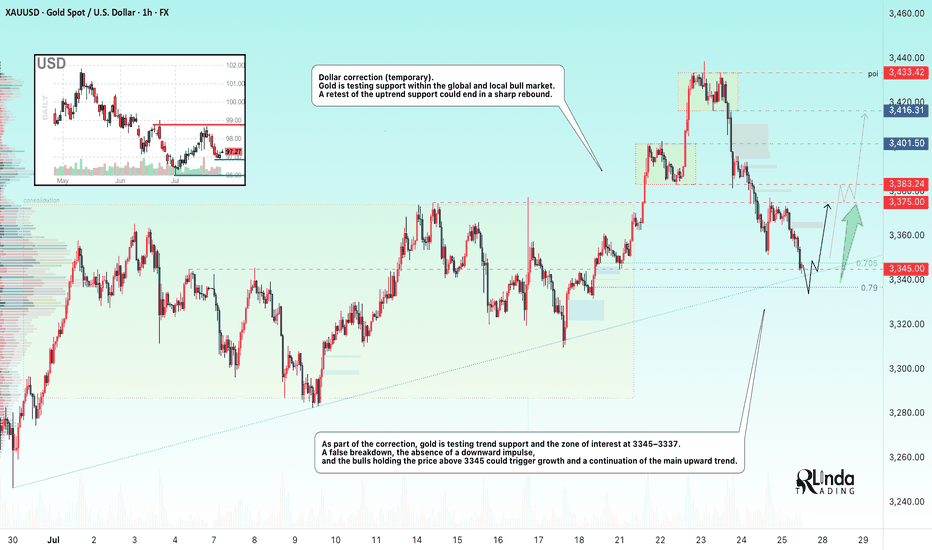

GOLD → Countertrend correction, retest of 3345 before growthFX:XAUUSD , undergoing a deep correction after a false breakout of local resistance at 3433, has reached the support of the upward trend. Will the bulls be able to maintain the trend?

Gold held below $3,400 on Friday, rebounding from $3,350, and is poised to end the week higher. Investors are w

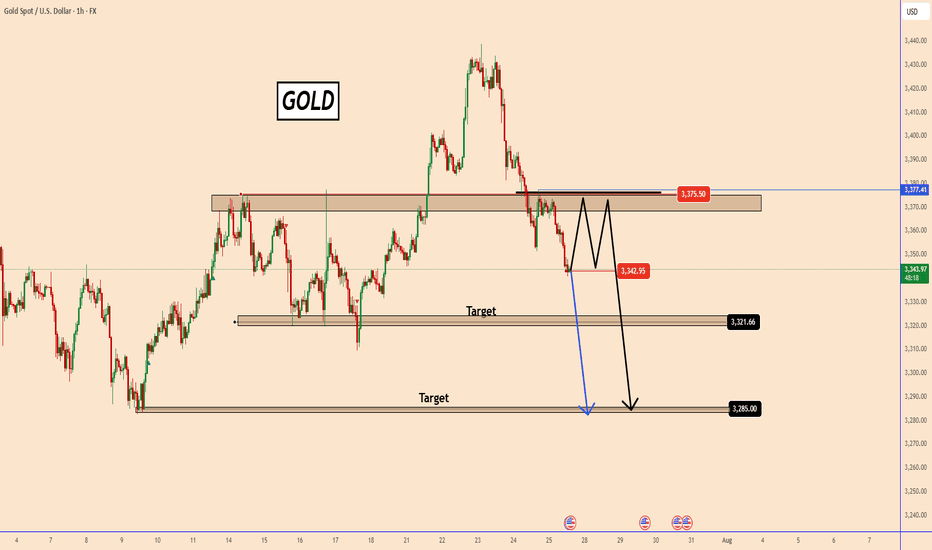

GOLD could test 3375 before falling furtherGOLD could test 3375 before falling further

In our previous analysis, we were looking for gold to fall from the top and, as we can see, it has already reached 3341 from the 3430 area.

From the top down, the price depreciated by 2.85% in less than 3 days, so a possible correction is expected near

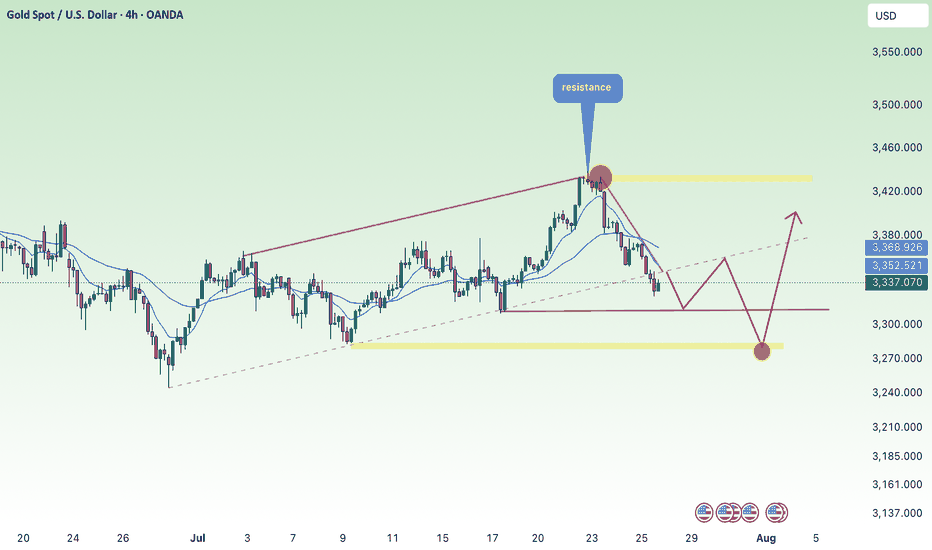

XAUUSD Weekly July 2025 28 July - 1 Aug🧭 MARKET STRUCTURE OVERVIEW – H4

1. Major Trend: Bullish

The overall trend remains bullish, with multiple Bullish Breaks of Structure (BOS) recorded during the upward move since early July.

A strong CHoCH followed by a solid Bullish BOS on H4 after the early July breakout confirms strong buyer in

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite decl

Gold is expected to experience a rebound next week.Gold recently dropped after reacting perfectly inside a higher time frame fair value gap. That zone acted as clean supply, offering a precise close within the imbalance and initiating a strong bearish leg. The move confirmed that buyers were overwhelmed at that level, and price began its descent bac

Losing over and over again? Losing over and over again? The problem isn’t your strategy – it’s your mind.

Let’s be honest:

Are you repeating the same old mistakes… even though you know they’re wrong?

You know you shouldn’t enter a trade without confirmation – but you still do.

You know you should stick to your stop-loss – but

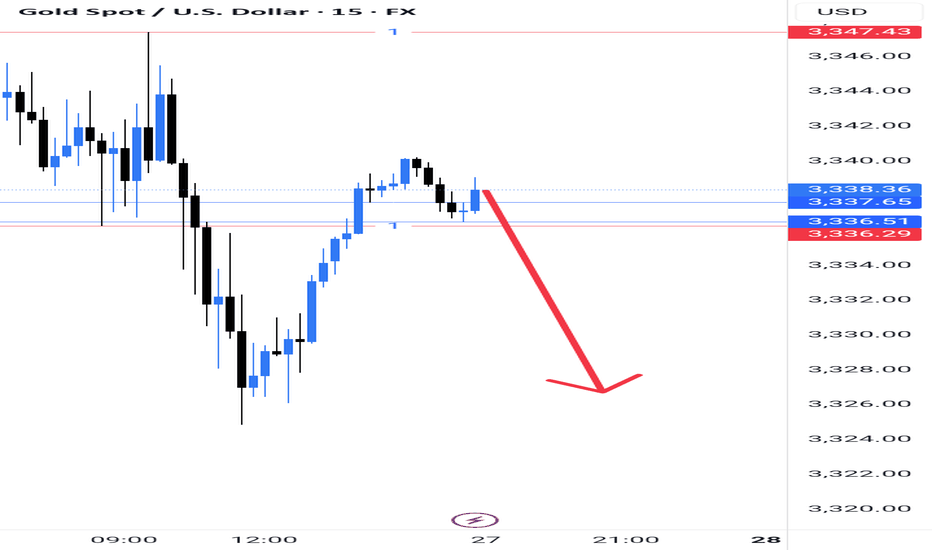

Daily XAUUSD Outlook — Riding the Fed Wave (July 28, 2025)Hey Gold Hunters! 🌟

Today feels like the calm before a storm—ADP whispers tomorrow, the Fed speaks Wednesday, and gold is inching toward its next big move. Let’s weave the macro pulse into our Smart‑Money map, highlight the five real zones, then plot our sniper‑perfect entries. No fluff—just the hum

See all futures ideas

News didn't load

Looks like that didn't go very well. Let's try again.

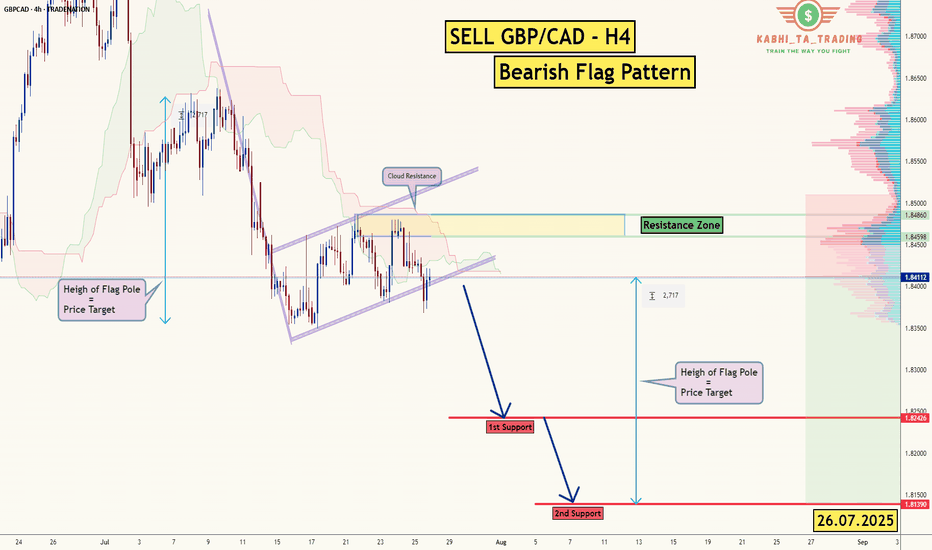

GBP/CAD - H4 - Bearish Flag (26.07.2025)The GBP/CAD Pair on the H4 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The P

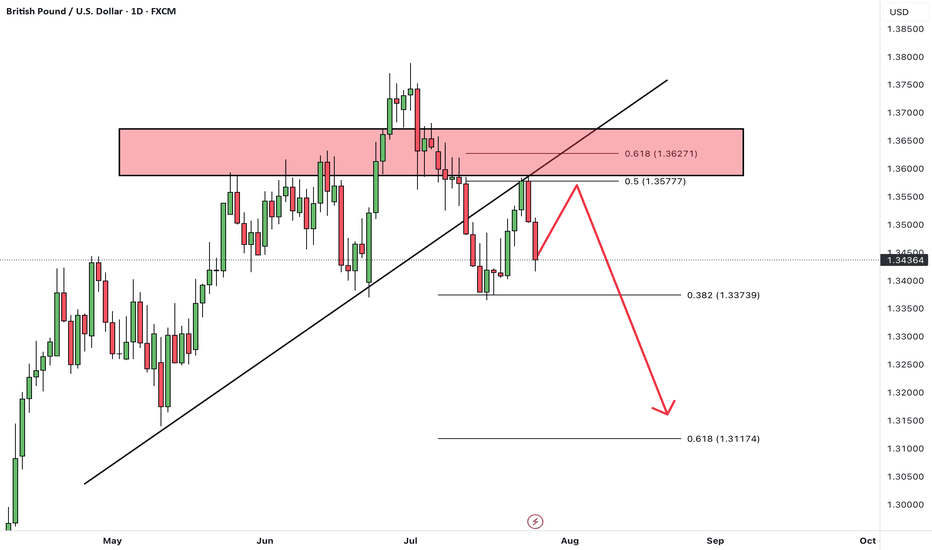

GBPUSDHello Traders! 👋

What are your thoughts on GBPUSD?

GBP/USD has broken below a trendline and has completed a retest (pullback) to the broken level.

The pair is now positioned for a potential downward move.

After some short-term consolidation, we expect price to drop at least toward the next identif

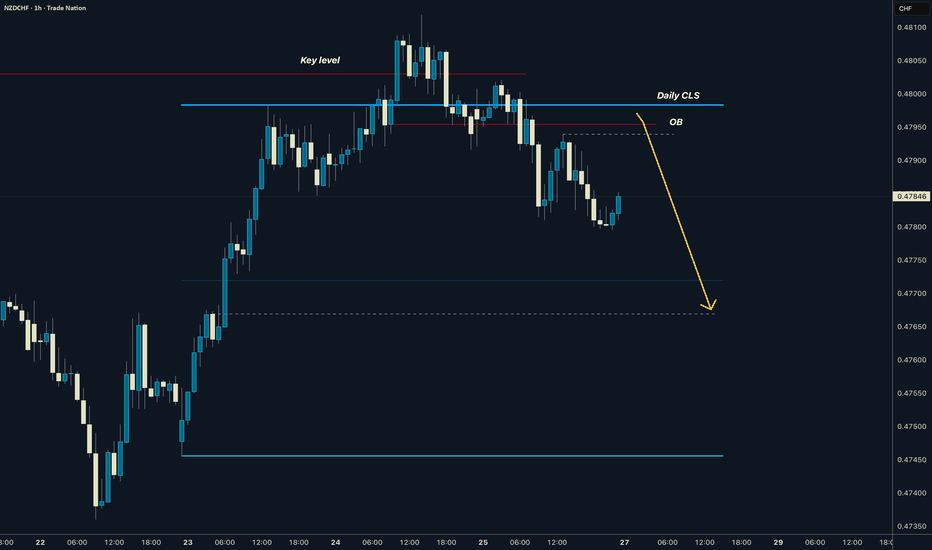

NZDCHF I Daily CLS I Model 1 I Pullback entryYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The i

GBP/USD 4H Bullish Reversal Setup Analysis:The chart shows GBP/USD breaking out of a descending channel, signaling a potential bullish reversal.

Price has bounced from a strong support zone (highlighted in yellow), with bullish momentum building.

The breakout is backed by a higher low structure, which often precedes an uptrend continuation

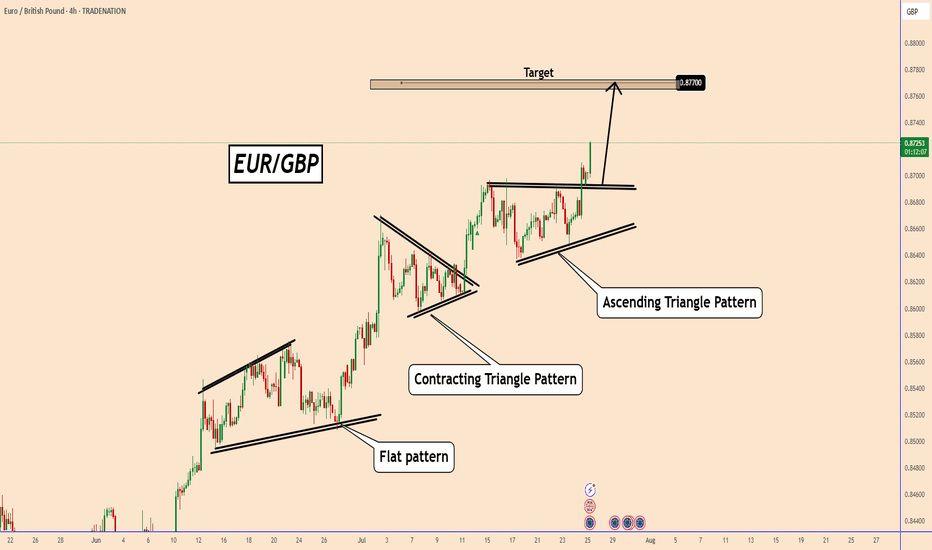

EURGBP Is Rising Further After UK Retail Sales missed estimatesEURGBP Is Rising Further After UK Retail Sales missed estimates

EURGBP already broke out from an Ascending Triangle pattern after it spent some time in accumulation and without direction the price is rising today.

This is the third and clear bullish pattern that EURGBP broke out and the chances

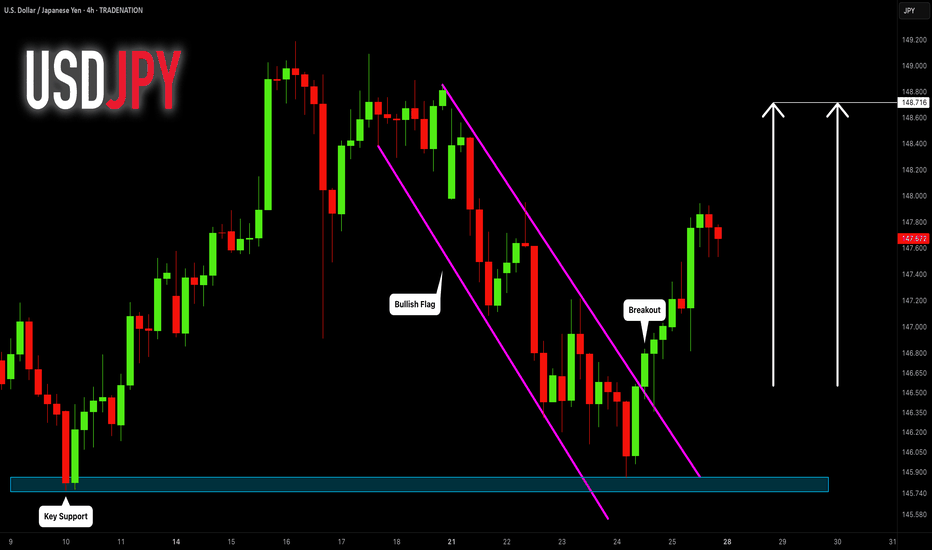

USDJPY: Bullish Move From Support Ahead! 🇺🇸🇯🇵

I think that there is a high chance that USDJPY will continue growing

next week.

A bullish breakout of a resistance line of a flag pattern that occurred

after a test of a key support provides a strong bullish signal.

Goal - 148.7

❤️Please, support my work with like, thank you!❤️

I am part

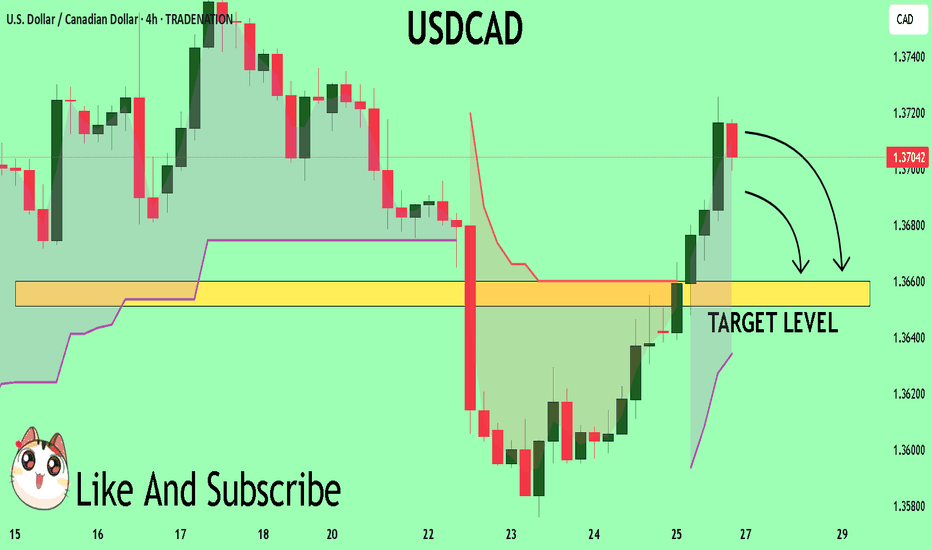

USDCAD Buyers In Panic! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3704

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Tar

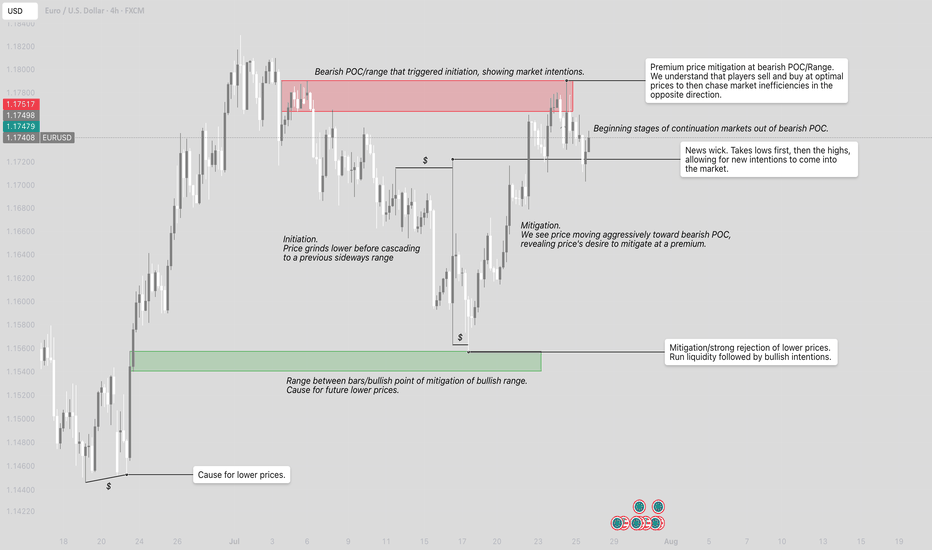

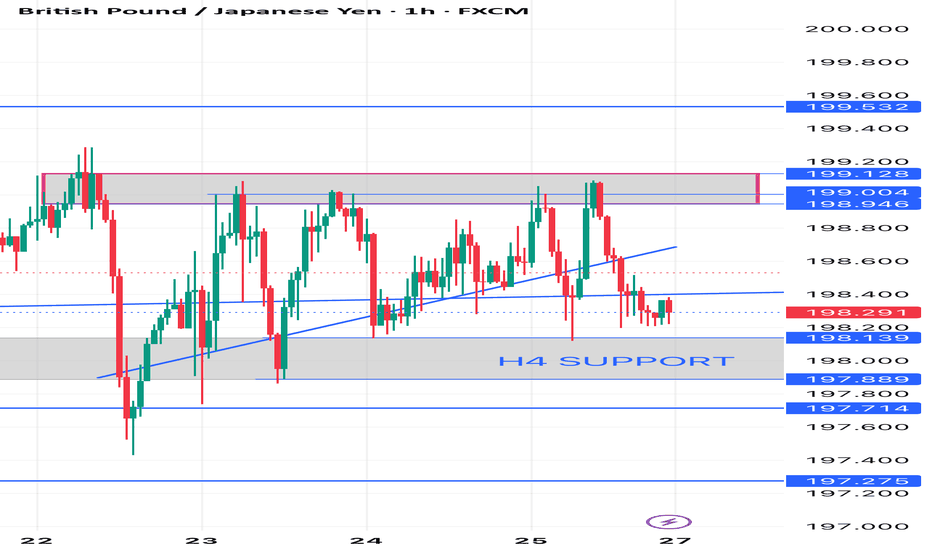

GBPJPY Daily chart analyses

Advanced Price Analysis with Timeframes

1. Key Observations from the Provided Data (H4 Chart)

Current Price197.800 testing the H4 SUPPORTlevel at 198.000

- Trend Downtrend (Lower Highs & Lower Lows).

- *Recent Structure

- Resistance ~199.600 (rejected multiple times).

- **Support -198.

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.