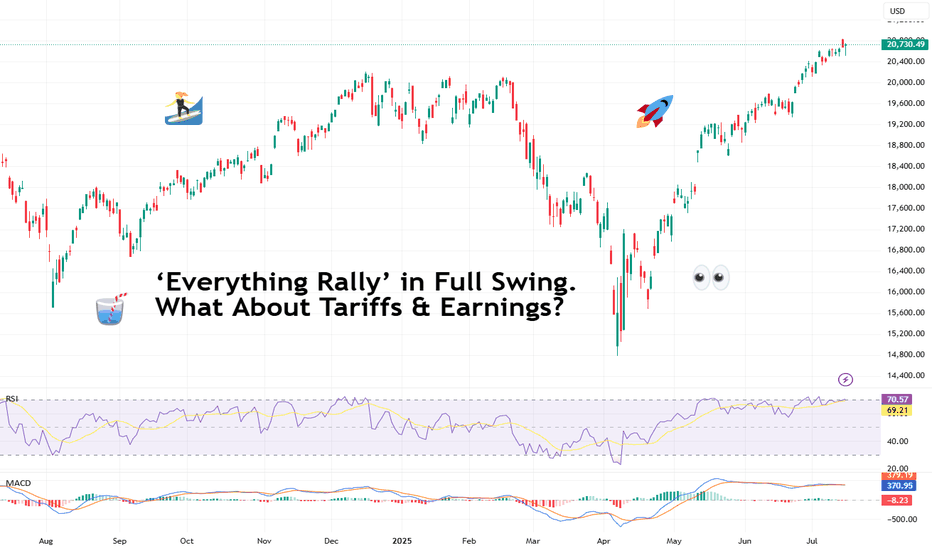

‘Everything Rally’ in Full Swing. What About Tariffs & Earnings?It’s official: we’re witnessing one of those rare, confounding moments when nearly every big risk-on thing is screaming ATH! (All-Time High, for those who haven’t worn out that abbreviation on X this month).

Bitcoin BITSTAMP:BTCUSD blew past $122,000 on Monday — a turbo rally that made anyone who

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

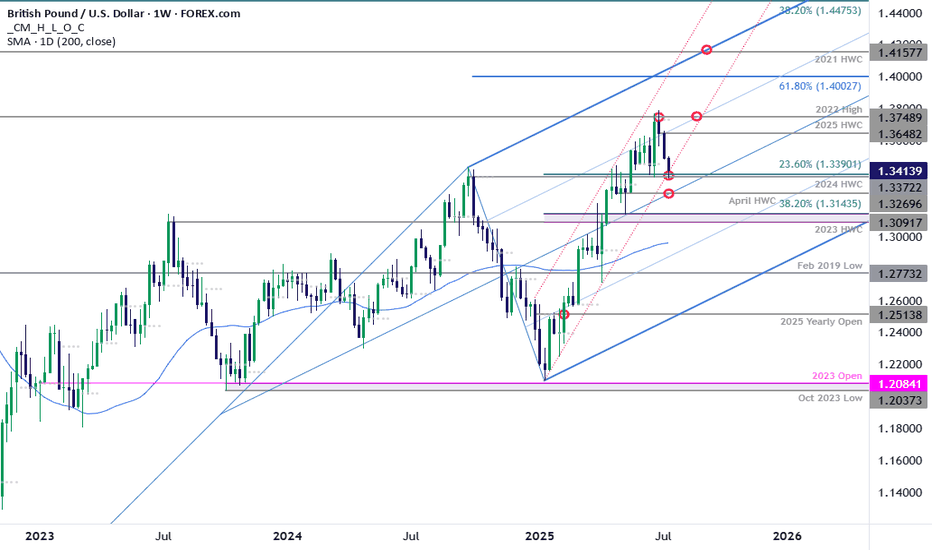

GBP/USD Plunges to Make-or-Break SupportSterling is poised to mark a third consecutive weekly decline after turning from resistance at multi-year highs. The decline takes price into critical support at the yearly trendline- this is a make-or-break level for the bulls.

GBP/USD is testing confluent support today at 1.3372/90- a region defi

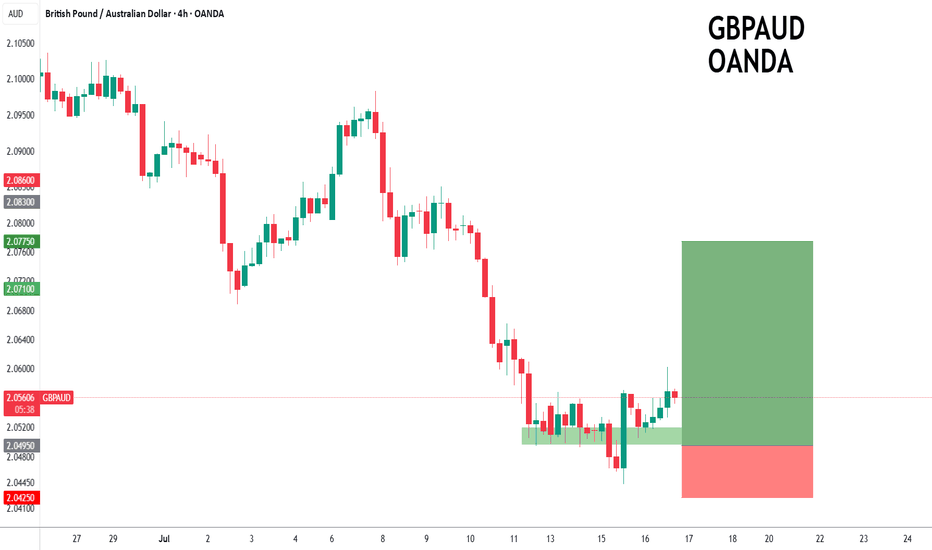

GBPAUD to turnaround?GBPAUD - 24h expiry

The primary trend remains bullish.

Price action looks to be forming a bottom.

We look for a temporary move lower.

Preferred trade is to buy on dips.

Bespoke support is located at 2.0495.

We look to Buy at 2.0495 (stop at 2.0425)

Our profit targets will be 2.0775 and 2.082

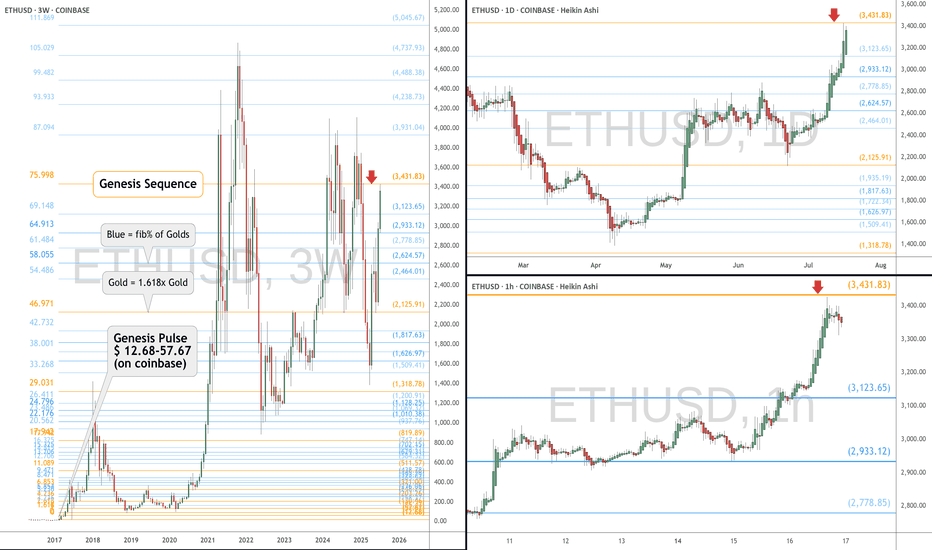

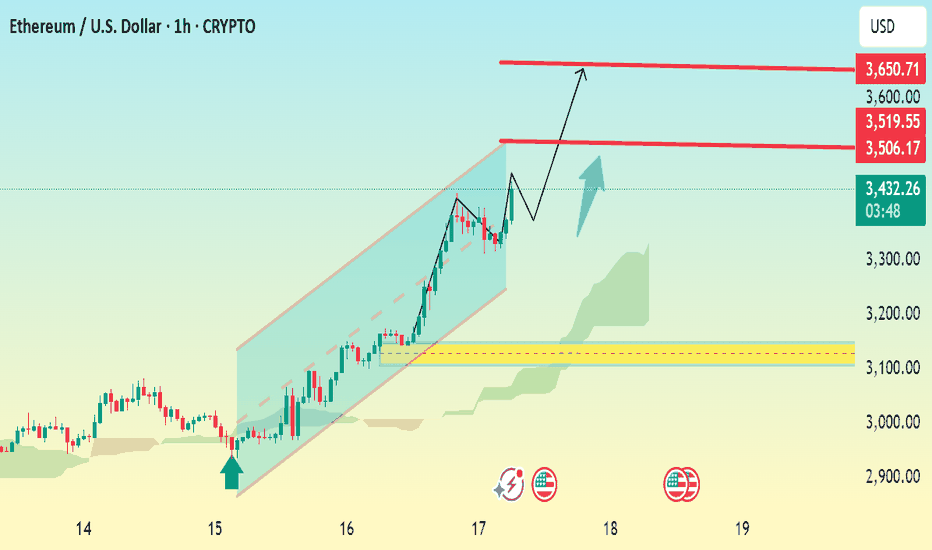

ETH eyes on $3431.83: Golden Genesis fib may END this SurgeETH finally got a surge after a long consolidation.

But has just hit a Golden Genesis fib at $3431.83

Like hitting a brick wall, it is now staggering back.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we reject here to end the surge.

It is PLAUSIBLE that we Break-n-Retest

Spotify's Valuation Is Red-Lining (Rating Downgrade)📈 Spotify's Remarkable Comeback

Spotify NYSE:SPOT has transformed itself from a money-losing audio platform into a disciplined, profit-generating tech firm. Through smarter podcast investments, layoffs, and better monetization strategies, the company recently swung from red ink to positive free c

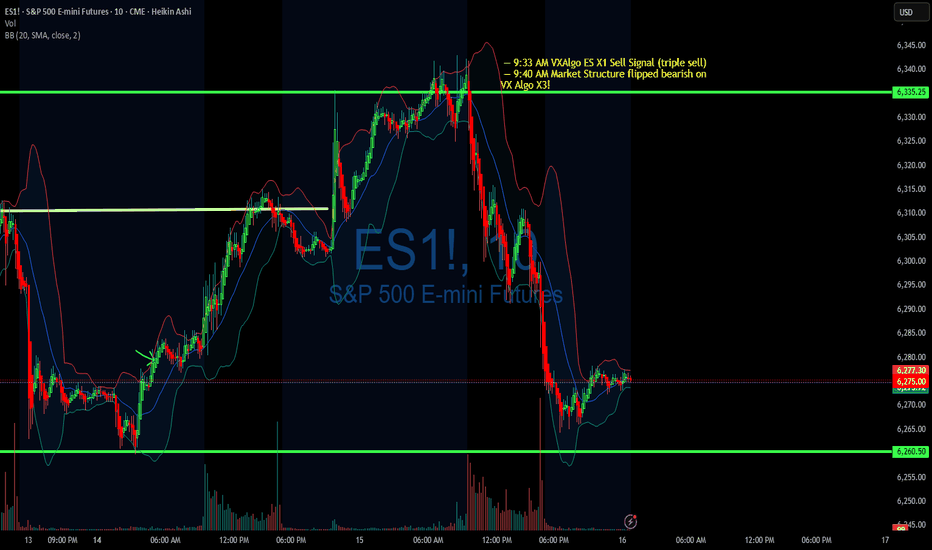

Using 1 min time frame for entries on VX algo & day tradingwhat time frames do you use to confirm entries outside of a buy signal?

If I am day trading, I will mainly use the 1 minute time frame to look for moving average support and resistance, and read the candle stick patterns as well from that chart.

However, there are times I'll switch to a 5 minute a

Trendline Breakout for Wave 3Navitas is currently looking at breaking out of its recent downtrend to potentially begin wave 3 of its move up, which, as we all know, is the most impulsive move.

Could be very tasty after a 350% pump already

Need to get above the range POC and breakout of the trend line, would be looking to get

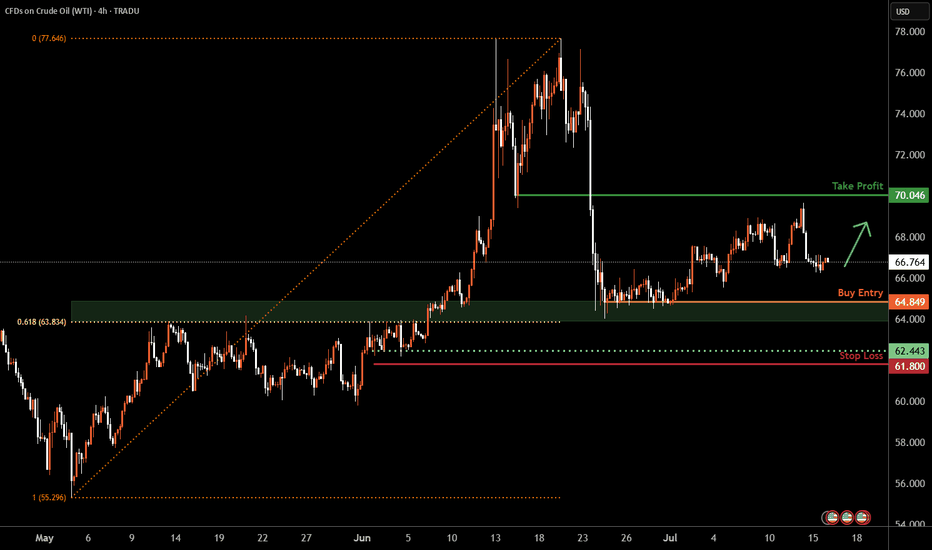

WTI Oil H4 | Potential bounce off a multi-swing-low supportWTI oil (USOIL) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 64.84 which is a multi-swing-low support that aligns closely with the 61.8% Fibonacci retracement.

Stop loss is at 61.80 which is a level that lies underneath a

BITCOIN- MONSTER ORDERS IN THE BOOK -> You Know What This Means COINBASE:BTCUSD “Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price.

Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level.

Once the wall

End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prio

See all editors' picks ideas

Crowding model ║ BullVision🔬 Overview

The Crypto Crowding Model Pro is a sophisticated analytical tool designed to visualize and quantify market conditions across multiple cryptocurrencies. By leveraging Relative Strength Index (RSI) and Z-score calculations, this indicator provides traders with an intuitive and detailed sn

Dynamic Gap Probability ToolDynamic Gap Probability Tool measures the percentage gap between price and a chosen moving average, then analyzes your chart history to estimate the likelihood of the next candle moving up or down. It dynamically adjusts its sample size to ensure statistical robustness while focusing on the exact de

EVaR Indicator and Position SizingThe Problem:

Financial markets consistently show "fat-tailed" distributions where extreme events occur with higher frequency than predicted by normal distributions (Gaussian or even log-normal). These fat tails manifest in sudden price crashes, volatility spikes, and black swan events that traditi

Divergence Screener [Trendoscope®]🎲Overview

The Divergence Screener is a powerful TradingView indicator designed to detect and visualize bullish and bearish divergences, including hidden divergences, between price action and a user-selected oscillator. Built with flexibility in mind, it allows traders to customize the oscillator

Logarithmic Moving Average (LMA) [QuantAlgo]🟢 Overview

The Logarithmic Moving Average (LMA) uses advanced logarithmic weighting to create a dynamic trend-following indicator that prioritizes recent price action while maintaining statistical significance. Unlike traditional moving averages that use linear or exponential weights, this indic

Volumatic Support/Resistance Levels [BigBeluga]🔵 OVERVIEW

A smart volume-powered tool for identifying key support and resistance zones—enhanced with real-time volume histogram fills and high-volume markers.

Volumatic Support/Resistance Levels detects structural levels from swing highs and lows, and wraps them in dynamic histograms that re

True Close – Institutional Trading Sessions (Zeiierman)█ Overview

True Close – Institutional Trading Sessions (Zeiierman) is a professional-grade session mapping tool designed to help traders align with how institutions perceive the market’s true close. Unlike the textbook “daily close” used by retail traders, institutional desks often anchor their

Open Interest Footprint IQ [TradingIQ]Hello Traders!

Th e Open Interest Footprint IQ indicator is an advanced visualization tool designed for cryptocurrency markets. It provides a granular, real-time breakdown of open interest changes across different price levels, allowing traders to see how aggressive market participation is distribu

Zigzag CandlesCan't deny that I am obsessed with zigzags. Been doing some crazy experiments with it and have many more in pipeline. I believe zigzag can be used to derive better trend following methods. Here is an attempt to visualize zigzag as candlesticks. Next steps probably to derive moving average, atr (alth

MathStatisticsKernelFunctionsLibrary "MathStatisticsKernelFunctions"

TODO: add library description here

uniform(distance, bandwidth) Uniform kernel.

Parameters:

distance : float, distance to kernel origin.

bandwidth : float, default=1.0, bandwidth limiter to weight the kernel.

Returns: float.

triangular(distance

See all indicators and strategies

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

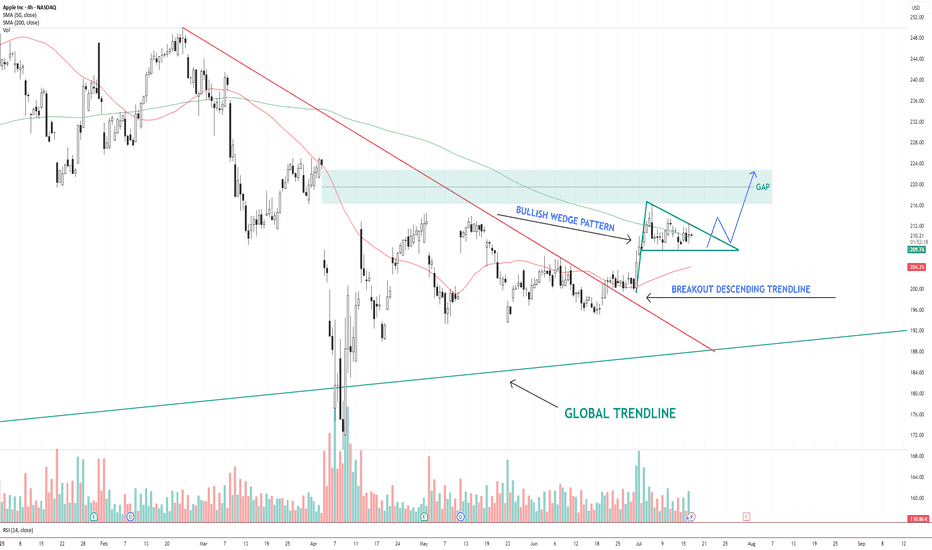

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting

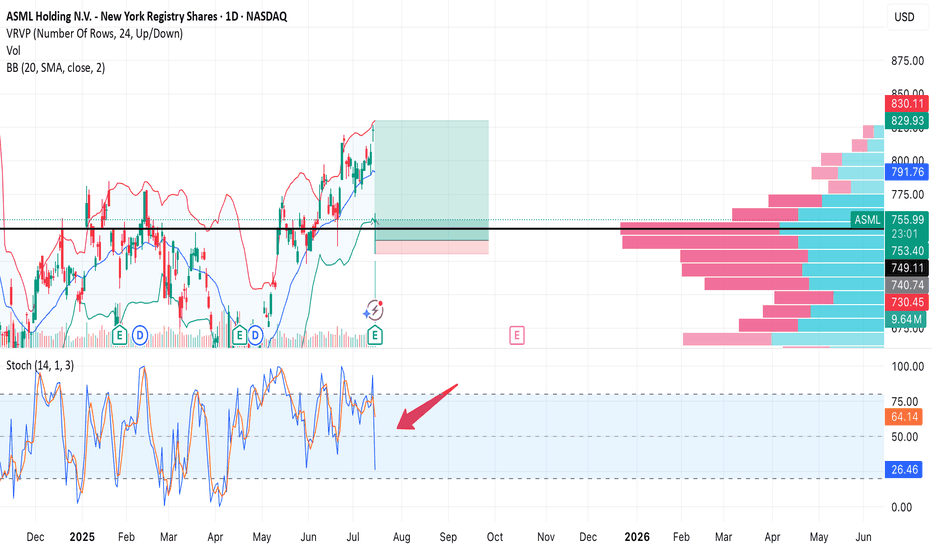

ASML — Strong earnings, sharp drop on profit-taking. Second chanAfter a strong quarterly report, NASDAQ:ASML stock initially surged, but then dropped -7.6% in a single session. Most likely due to profit-taking and a broader tech sector correction. Still, the key $754 support held, and the uptrend remains intact.

Trade Setup:

• Buy Zone: $754–760 (on retest)

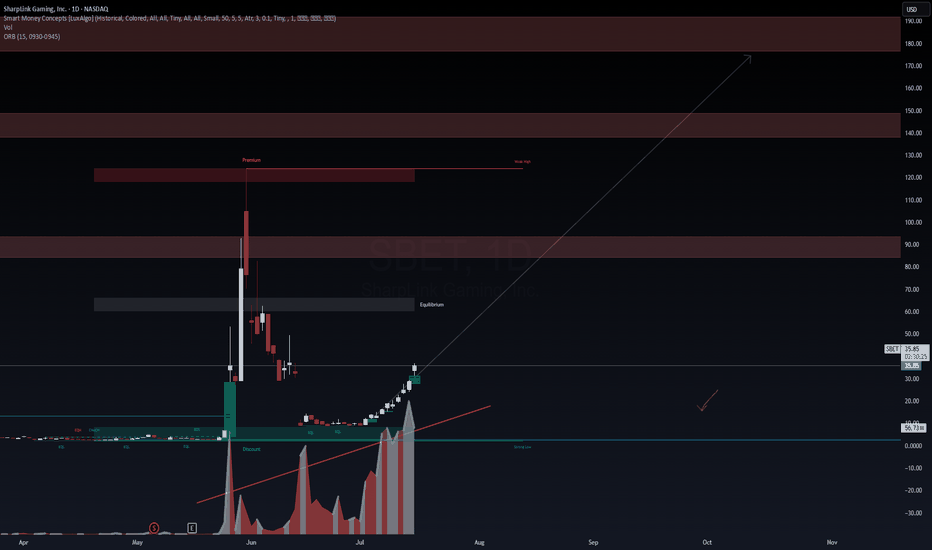

Unusual Volume Surge in $SBET — What’s Going On?NASDAQ:SBET is up 24.11% today, but the accumulation pattern seems... off. Volume looks suspiciously inflated.

Is this just a short-term squeeze or is there something deeper brewing behind the scenes?

Anyone familiar with the fundamentals or insider activity on this name? Drop insights below — curi

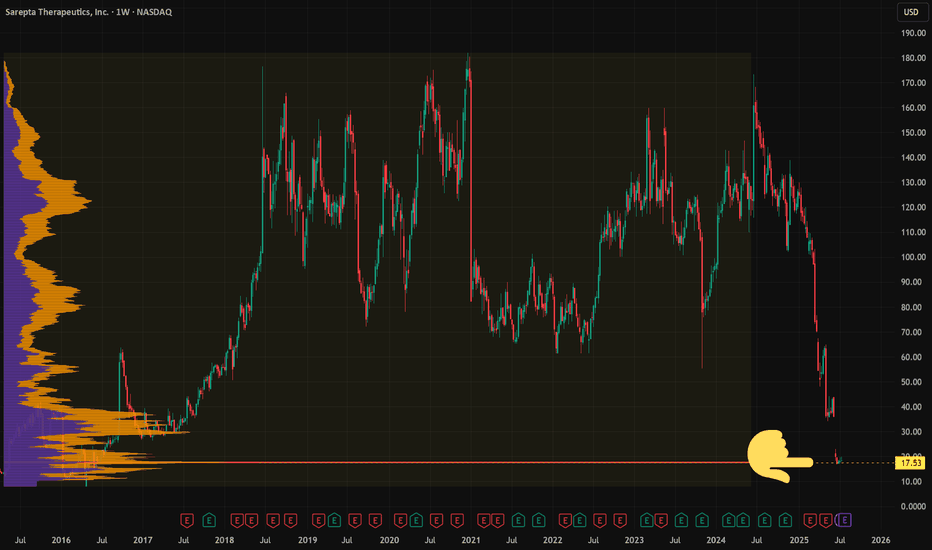

I'm scared of this stock and I'm buyingWall St. has already written the obituary on NASDAQ:SRPT —but that’s exactly why I’m stepping in.

Back in 2020 (link below) I traded a setup from a Spike at 50% Retracement up to its prior ATH near $170, cashed out, dodged the drug-trial IV grenade. I saw 50% of market cap evaporate in a gap. S

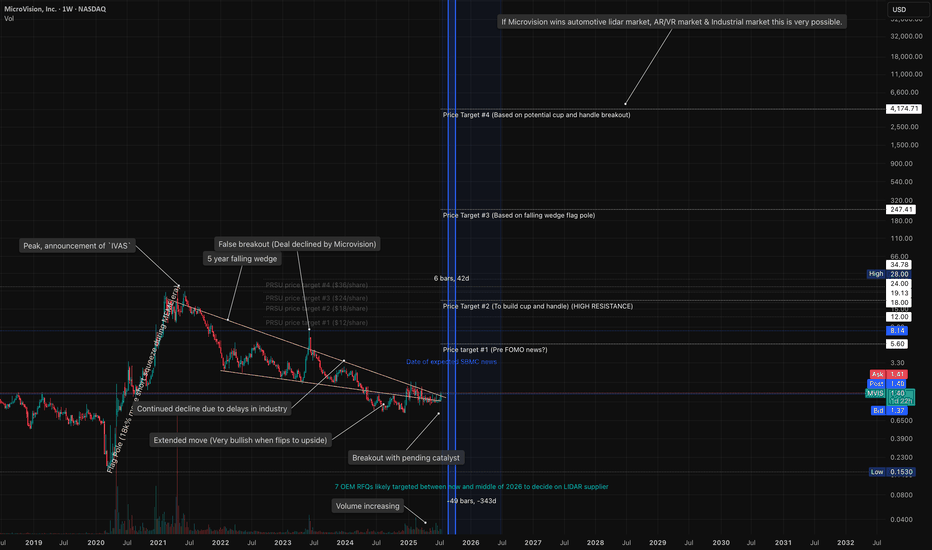

Markets Converging MVIS market changing potentialMicrovision is weeks away from hitting an intense inflection point.

Pending news for SBMC (decision date August 29th )

Microvision is partnered with NVDA for their driving lidar and software -- and have a plug and play system better than any competitor. (an update was made to MVIS website while

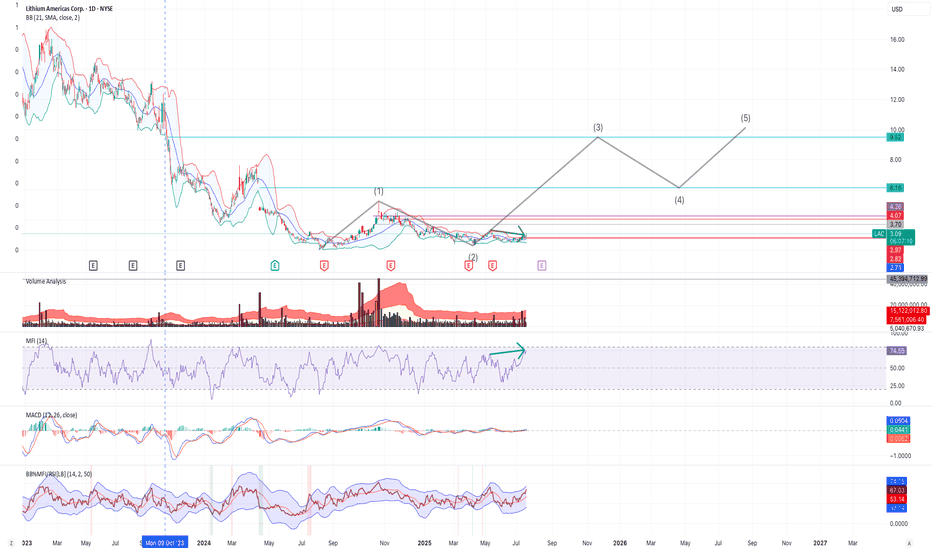

The 3rd Nevada Lithium Elliot WaveI believe LAC may have begun its 3rd elliot wave, with a bottom at $2.33. There also appears to be nice recent strong base support around $2.80. In addition, there appears to be a deviation between price and money flow, as shown with the green arrows - with a potential correction available to push p

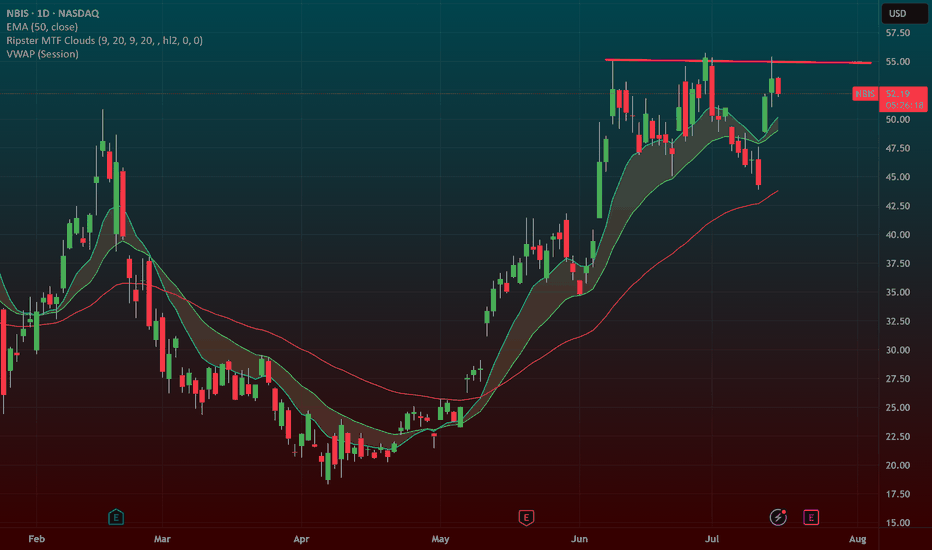

NBIS 55 BREAKOUT in the works!NBIS is an AI darling and a big momentum stock. When it goes it goes! it has been testing this 55 level for some time now.

We recently had a big GS upgrade that "woke" it up. A rest day here and another one will let the 9ema catch up to it and allow for a big breakout. If we take out this trendl

See all stocks ideas

Today

TCBITexas Capital Bancshares, Inc.

Actual

1.58

USD

Estimate

1.29

USD

Today

ELVElevance Health, Inc.

Actual

8.84

USD

Estimate

8.91

USD

Today

PEPPepsiCo, Inc.

Actual

2.12

USD

Estimate

2.03

USD

Today

CFGCitizens Financial Group, Inc.

Actual

0.92

USD

Estimate

0.88

USD

Today

IIINInsteel Industries, Inc.

Actual

0.78

USD

Estimate

0.69

USD

Today

FITBFifth Third Bancorp

Actual

0.88

USD

Estimate

0.87

USD

Today

SNASnap-On Incorporated

Actual

4.72

USD

Estimate

4.63

USD

Today

MMCMarsh & McLennan Companies, Inc.

Actual

2.72

USD

Estimate

2.67

USD

See more events

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

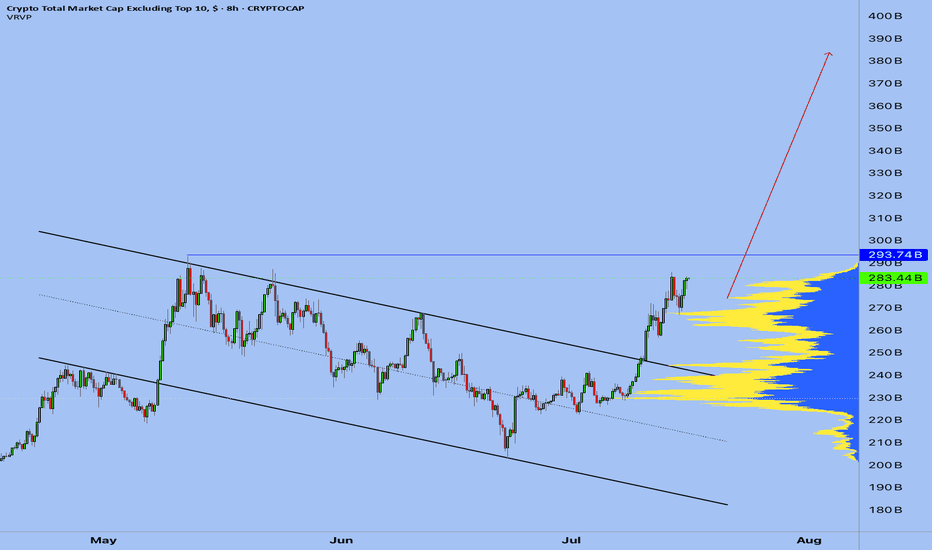

2/ Altseason: Live - My Coin-Picking StrategyThe "Altseason: Live" experiment has unofficially begun. While many are debating if altseason will happen at all, I prefer to act. We may not see a classic, market-wide surge across all coins. The market has changed. But I believe that targeted, explosive opportunities always exist.

In this post, I

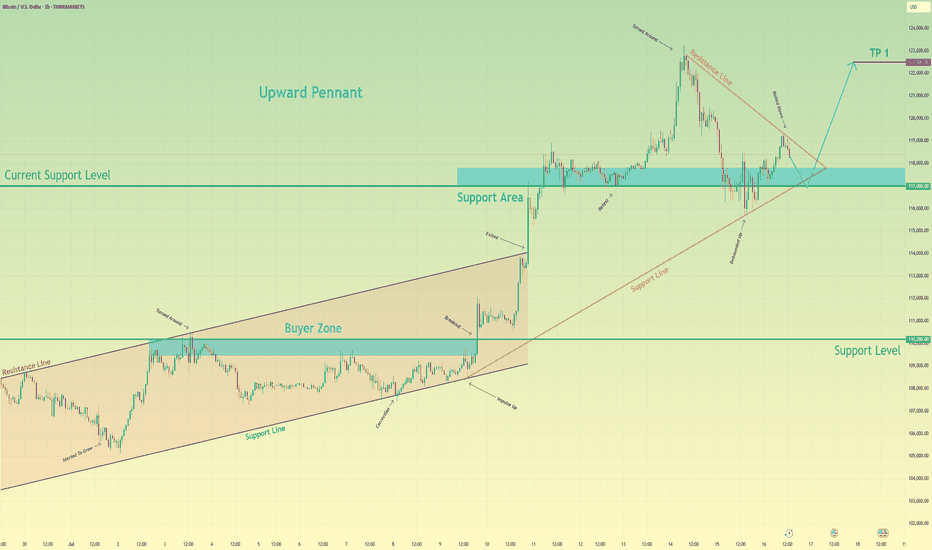

Bitcoin may exit of pennant and then rebound up of support areaHello traders, I want share with you my opinion about Bitcoin. Earlier, the price was moving inside an upward channel, respecting both the resistance and support boundaries. After reaching the buyer zone (110200–109500 points), BTC made a strong impulse up, breaking out of the channel and entering a

ETH eyes on $3431.83: Golden Genesis fib may END this SurgeETH finally got a surge after a long consolidation.

But has just hit a Golden Genesis fib at $3431.83

Like hitting a brick wall, it is now staggering back.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we reject here to end the surge.

It is PLAUSIBLE that we Break-n-Retest

Bitcoin - Reversal Setup or Just a Trap Reset?Price faked below the 1H support zone around 115,800, triggering a clean run through resting sell stops. This classic liquidity sweep flushed out early long positions before immediately reclaiming the range. The move aggressively filled a prior imbalance and flipped sentiment just when it seemed the

Bitcoin - Will hit 135k in the short-term, Elliott and FIBOBitcoin is rising! That's what everyone sees at the moment, but we don't want to get drunk and establish our profit target. Where to take profit? Because we are in the price discovery mode, there is no previous price action above the current price. At this moment we really cannot use any horizontal

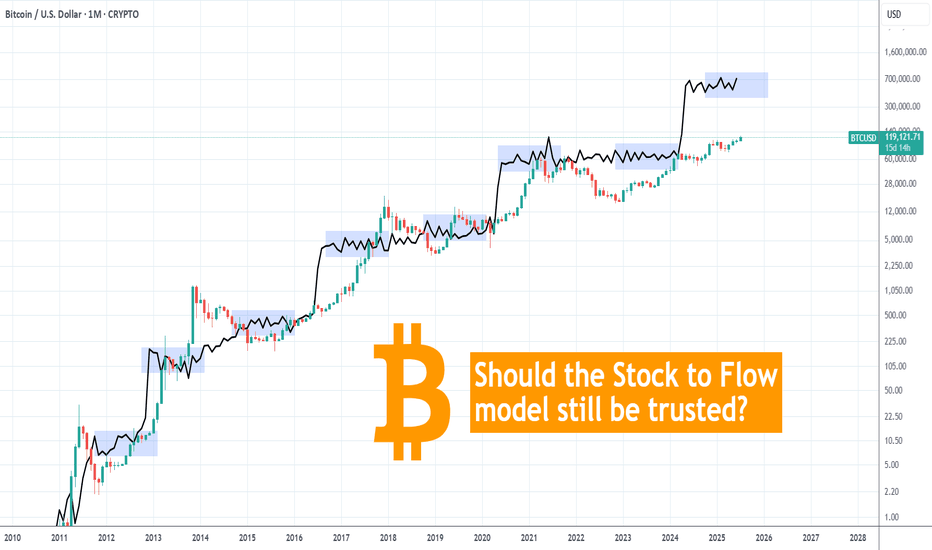

BITCOIN Should we still trust the Stock to Flow model??It sure worked perfectly during Bitcoin's (BTCUSD) first Cycles, but the Stock-to-Flow model has greatly diverged from the current price action since March 2024.

Right now the model sits at around $750000, which is vastly above the current market price of $119000. It's been trading sideways actuall

The Unicorn Breakout – Regression, Madness & Meme Math🦄 The Unicorn Breakout – Regression, Madness & Meme Math

FX_Professor | July 14, 2025

🎨 Welcome to my world…

Some draw straight lines.

I draw quadratic regression channels, alien spirals, and unicorns.

Because sometimes, the market is not just math — it’s emotion, storytelling, and madness t

ETHUSD 1h Bullish Reversal SetupChart Analysis Summary:

Current Price:

$3,429.21 (at the time of the screenshot)

Trend:

Strong uptrend within a bullish ascending channel.

Price has been respecting the trendline and moving upward steadily.

Key Chart Patterns & Tools:

Ascending Channel: ETH is trading within an upward slopi

BITCOIN- MONSTER ORDERS IN THE BOOK -> You Know What This Means COINBASE:BTCUSD “Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price.

Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level.

Once the wall

BTC Bull Flag Target Hit Is $150K Now on the Table?Bitcoin continues to deliver with precision. If you’ve been following the structure, this breakout is no surprise. We had a textbook bullish flag setup earlier in the cycle clean pole, sideways consolidation, and a sharp breakout. That initial flag target has now been achieved.

But here’s where i

See all crypto ideas

News didn't load

Looks like that didn't go very well. Let's try again.

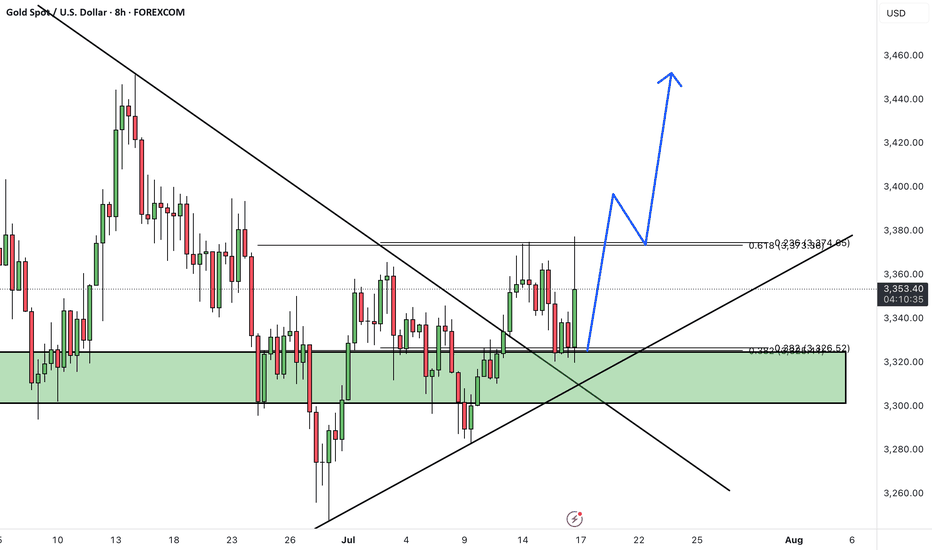

GOLD → Borders are shrinking. Consolidation continues...FX:XAUUSD is adjusting amid controversial CPI data and confirming the local bearish market structure. The PPI is ahead, and gold is consolidating, with its boundaries continuing to narrow...

Gold is recovering slightly but remains under pressure amid rising bond yields and a stronger US dollar

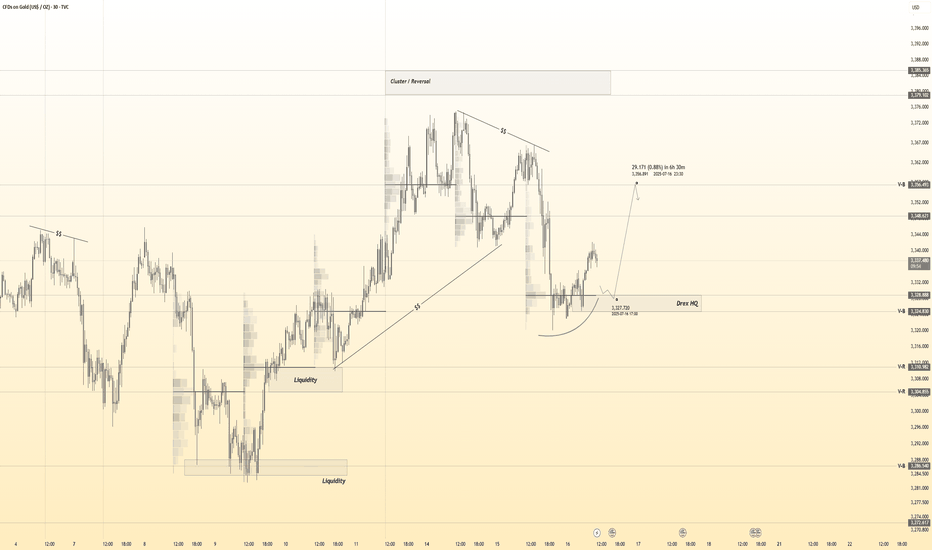

Gold 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal 3329 Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising

TLong

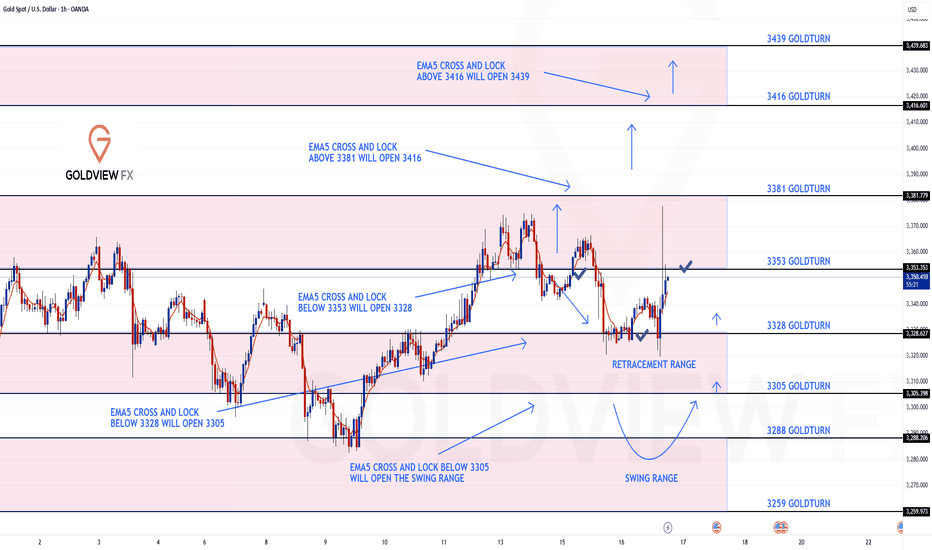

1H CHART ROUTE MAP UPDATEHey Everyone,

Quick follow up on yesterday’s 1H chart update

Today, we saw exactly the type of reaction we were looking for at the 3328 retracement level. Price respected the zone perfectly, offering a clean bounce, just as we anticipated and stated yesterday. There was no EMA5 cross and lock bel

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold has broken above its descending trendline and completed a successful pullback to the breakout level. Now, the price appears ready to resume its upward move, but it's still facing resistance near the $3375 level.

We expect another attempt to bre

FLong

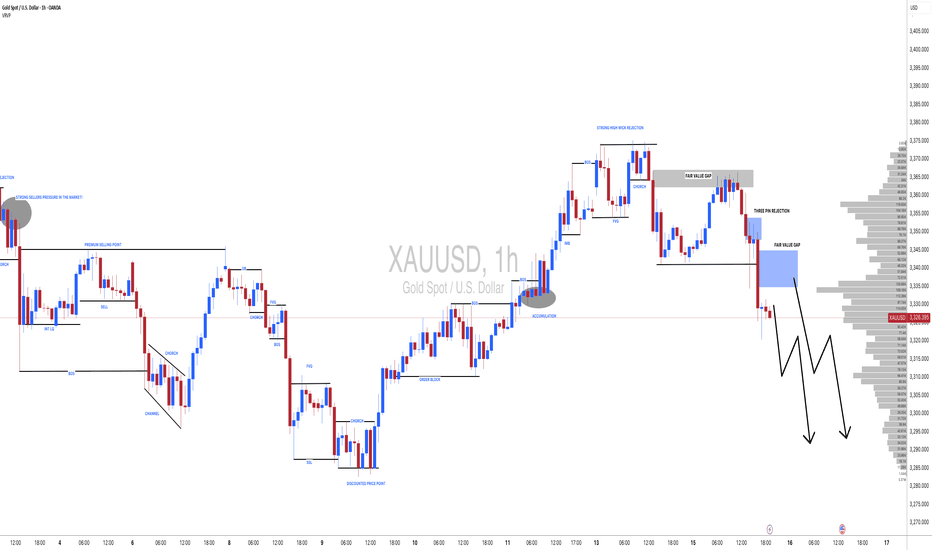

#XAUUSD(GOLD): Strong Sellers Hold, Further Drop Incoming! God dropped from our area of entry yesterday as we initially expected. However, since the massive drop, we are now seeing some short-term correction in the prices. In the coming time, we can expect further price drops around 3280 or 3250.

If you like our idea, please like and comment.

Team Setupsf

OShort

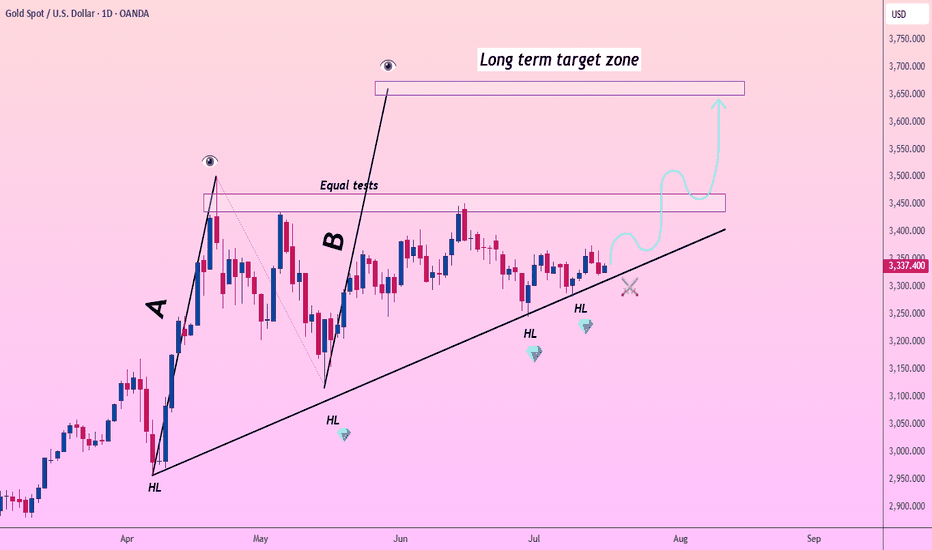

Lingrid | Gold ready to Make BoostOANDA:XAUUSD maintains a solid bullish structure with a clear series of higher lows (HLs) forming along the ascending trendline. After strong impulsive waves labeled A and B, price has repeatedly tested the resistance zone around 3450–3460, creating a double-top-like structure with equal tests. A c

OLong

Gold – Bullish Structure Still Intact, but Bears are Knocking📉 What happened yesterday?

As expected, XAUUSD made another leg down, breaking even below my buy zone (3330–3335) and hitting a low at 3320. From there, we’re now seeing a modest rebound, with gold trading around 3333 at the time of writing.

📌 Current position:

I'm currently holding a long posi

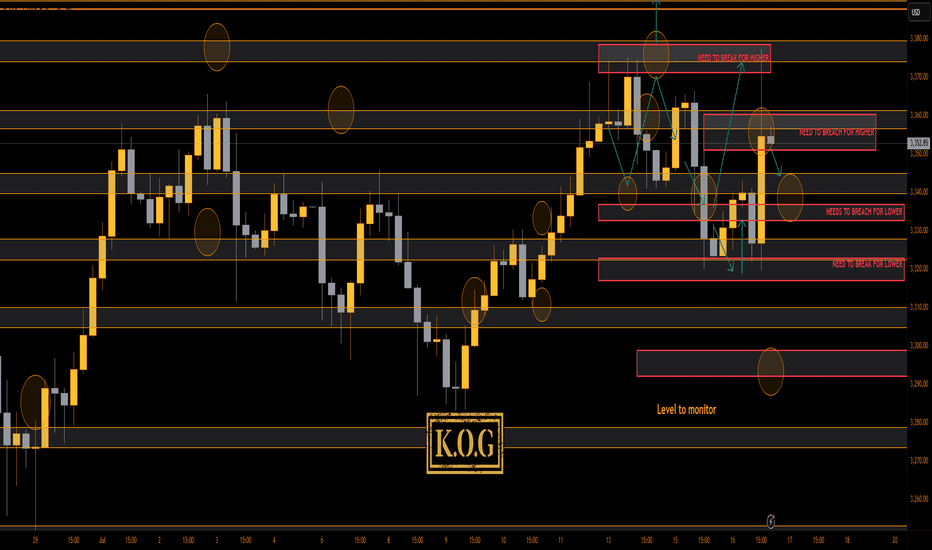

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

That was a difficult move to capture! I would not blame anyone for getting frustrated and FOMO'ing. Thankfully, we stuck to our guns, price was manipulated but our targets are completed as is the move we highlighted on Sundays KOG Report. I even say here an

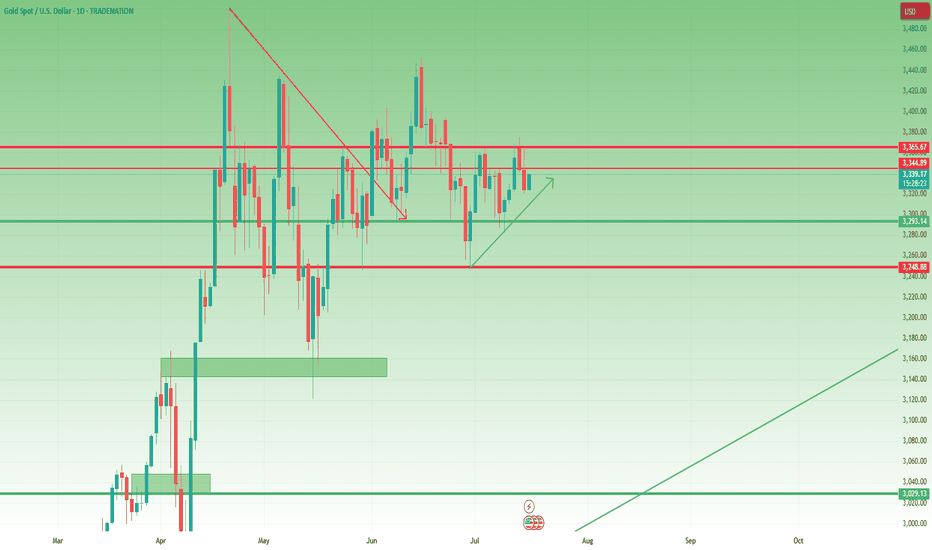

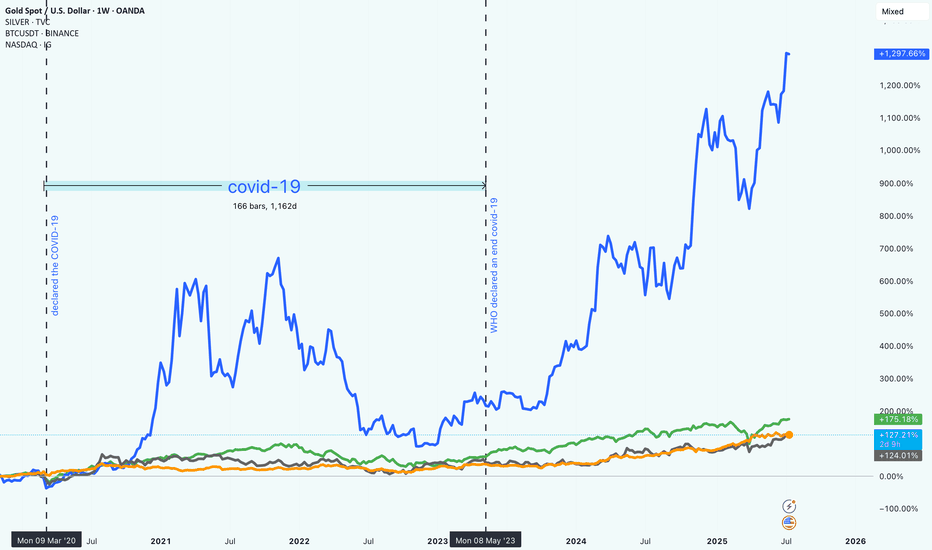

Market Trends from 2020 to 2025How Bitcoin, NASDAQ, Gold, and Silver Really Performed Since 2020

It’s been a wild few years in the markets. From early 2020 to mid-2025, investors have had to navigate uncertainty, changing interest rates, tech booms, and the rise of digital assets. Looking back, it’s clear that some assets took

GOLD Set for Big Move? | Key Zones + CPI Impact Explained !Gold Analysis – Key Levels + CPI Outlook!

In this video, I broke down the recent rejection from the $3366–$3369 resistance zone, the drop to $3346, and current price action around $3357.

We’ll also look ahead at what to expect with the upcoming CPI report — and how it could shape gold’s next big mo

See all futures ideas

News didn't load

Looks like that didn't go very well. Let's try again.

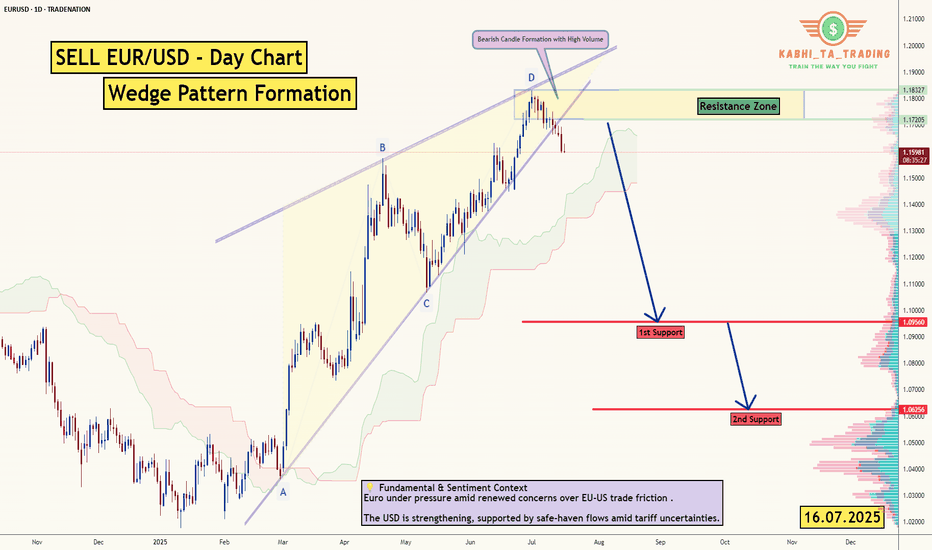

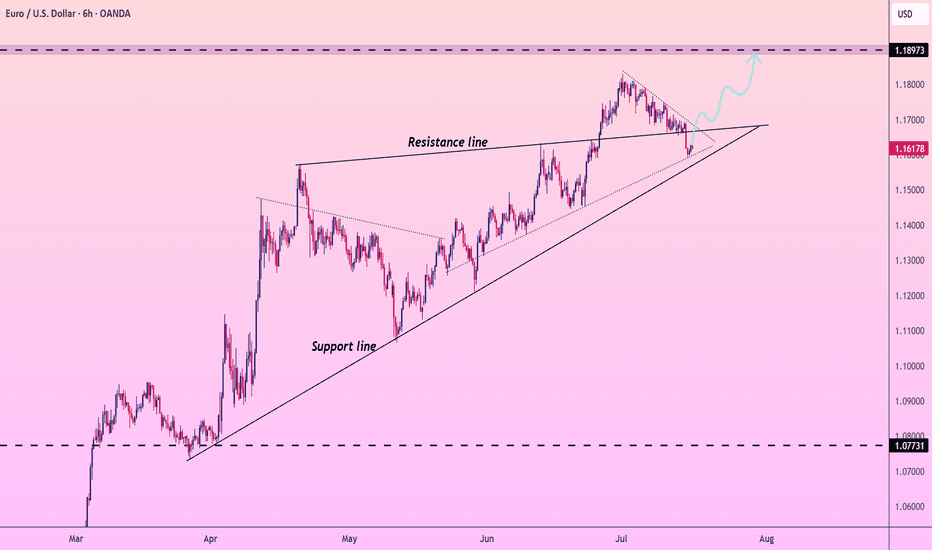

EUR/USD - Daily Chart (Wedge Breakout) (16.07.2025) The EUR/USD Pair on the D1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Wedge Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

EURUSD has broken support level and its ascending trendline, indicating a possible shift in short-term market structure and growing bearish pressure.

In the short term, we expect a pullback toward the broken support/trendline zone.

If price fails

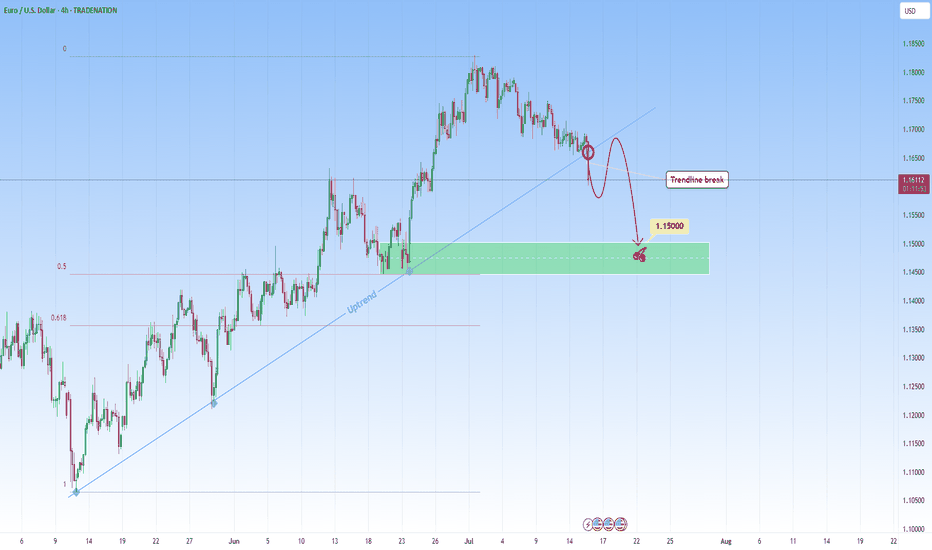

EURUSD: Sell Opportunity after Trendline breakEURUSD was in a steep uptrend but it might stop with this recent break through the uptrend. A break like this one on a strong trendline that had multiple touches, indicates either a potential reversal or major pause in the trend. This candle that broke the trendline signals the first hint of structu

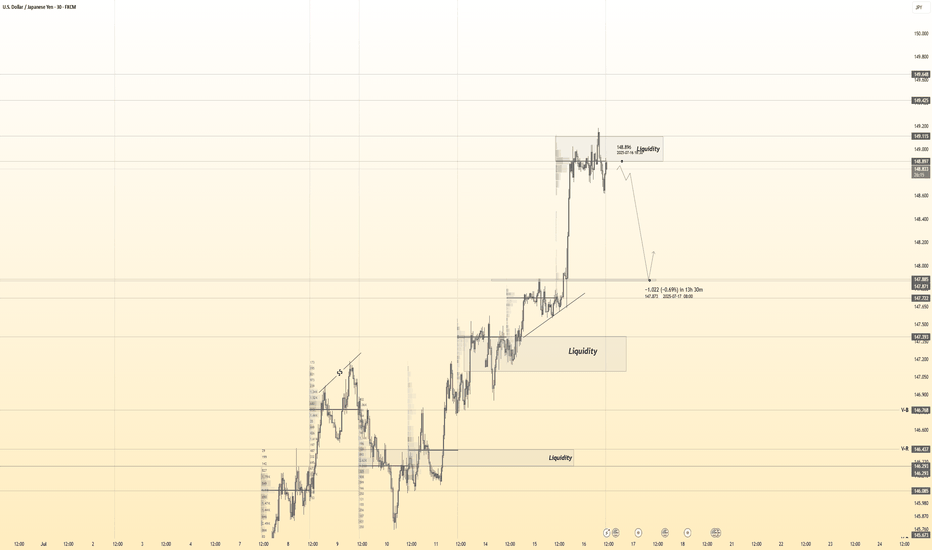

USDJPY 30Min Engaged ( Bearish Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish move from : 148.900 Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is r

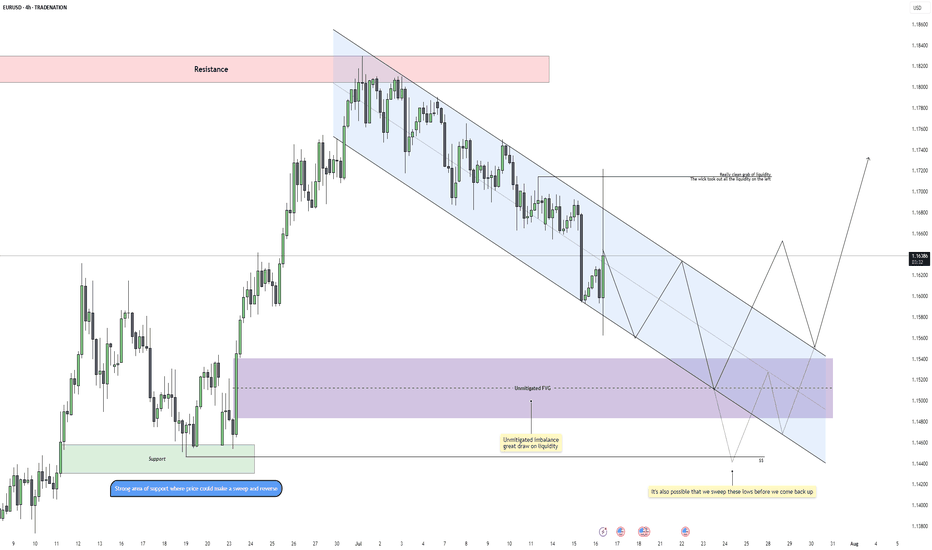

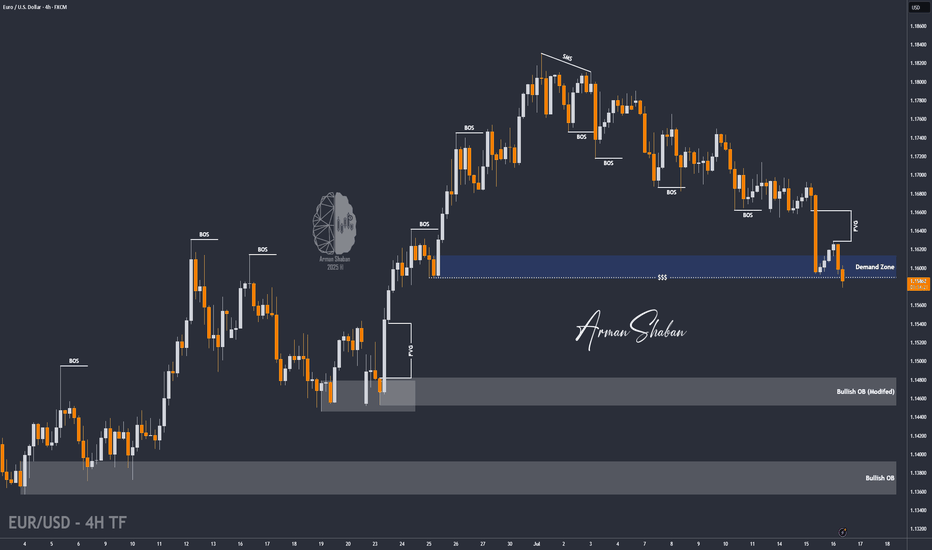

EURUSD – Bearish Rhythm ContinuesEURUSD is currently moving within a well-defined descending channel on the 4H timeframe, maintaining a consistent pattern of lower highs and lower lows. This confirms that bearish order flow remains intact, especially after the recent rejection from the upper boundary of the channel. The previous mo

USDCHF – Reversal Setup Building Above 0.79 SupportUSDCHF has broken out of its steep downward channel and is now forming a potential bullish reversal base above the key support zone at 0.7940–0.7870. Price action suggests momentum could be shifting in favor of the bulls, with upside targets sitting at 0.8100 (Fibonacci 38.2%) and 0.8210 (previous r

EUR/USD : Another Fall Ahead ? (READ THE CAPTION)By analyzing the EURUSD chart on the 4-hour timeframe, we can see that the price is currently breaking through the 1.16–1.158 zone. If it manages to hold below 1.159, we can expect further downside movement. The next targets for EURUSD are 1.15580, 1.154, and 1.148.

Please support me with your lik

EURUSD Under Pressure After Hot CPI – More Downside Ahead?Today, the US released key inflation figures :

Core CPI m/m: 0.2% (vs 0.3% forecast)

CPI m/m: 0.3% (as expected)

CPI y/y: 2.7% (vs 2.6% forecast, up from 2.4%)

Fundamental Analysis ( EURUSD ):

The slightly lower Core CPI suggests some easing in underlying inflation pressures. However,

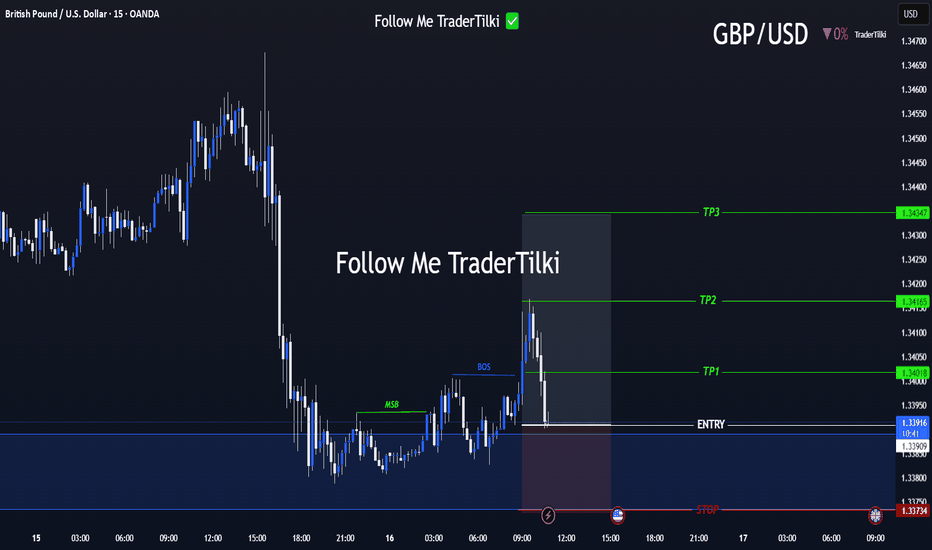

Strategic Entry, Clear Targets: The GBPUSD Game Plan Is Set📢 Hello Guys,

I've prepared a fresh GBPUSD signal for you:

🟢 Entry Level: 1.33918

🔴 Stop Loss: 1.33734

🎯 TP1: 1.34018

🎯 TP2: 1.34165

🎯 TP3: 1.34347

📈 Risk/Reward Ratio: 2,40

------

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone w

See all forex ideas

| EUR | USD | GBP | JPY | CHF | AUD | |||

|---|---|---|---|---|---|---|---|---|

| EUR | - | - | - | - | - | - | - | |

| USD | - | - | - | - | - | - | - | |

| GBP | - | - | - | - | - | - | - | |

| JPY | - | - | - | - | - | - | - | |

| CHF | - | - | - | - | - | - | - | |

| AUD | - | - | - | - | - | - | - | |

| CNY | - | - | - | - | - | - | - | |

| CAD | - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.