Ether Soars in Massive Rally — Is Altcoin Season Finally Here?Bitcoin who? Move over, orange coin. It's the alt season and Ethereum and its crew of alternatives are here to party.

🚀 Ether Edges Toward All-Time High

Ethereum BITSTAMP:ETHUSD is all the game in crypto town right now. Prices climbed another 3% early Thursday, cruising past $4,750 and now ju

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

ARM – Cup & Handle Pattern with Potential BreakoutOn ARM’s daily chart, we can see a clear Cup & Handle pattern – twice in a row – with strong upward moves following each completion.

The latest pattern completed around the $165 area, after which the stock pulled back into a healthy correction and is now consolidating in the $140–$150 range.

Techni

Circle buying opportunity. Bullish chartWith the announcement of the new stock release, more selling should come. I see limit entries of 139 and 144 to be ideal. Overall pattern is 4th wave correction IMO. Target at least double top in short term and much higher long term. People smarter than me would put stop losses under those targ

Cable & Fibre!So, generally I'm happy with the way the market is going. Though a little bit uncertain about how high it wants to go before it resumes its downward spiral, things are going good so far.

Looking at Cable, on an hourly chart, we see that between 06:00 am and 08:00 am (New York Time), there is FVG fo

Bitcoin, Ethereum Breakout: 401(k) funds & the next "Altseason"Bitcoin is up 10% in August, driven by strong ETF inflows and a game-changing executive order allowing 401(k) retirement funds to invest in cryptocurrencies, potentially bringing trillions of dollars into the sector.

Technically, Bitcoin and Ethereum are breaking out toward multi-year highs, with B

BITCOIN Bullflag and new all-time high ?!BULL FLAG and new all-time high 👀⏰

📇BTC daily-chart (BITSTAMP) and 💡everything important in the chart !

Bitcoin has broken out of its sideways consolidation and has recently successfully tested this channel (bull flag), thereby activating a potential bull flag.

The resulting targets (see example

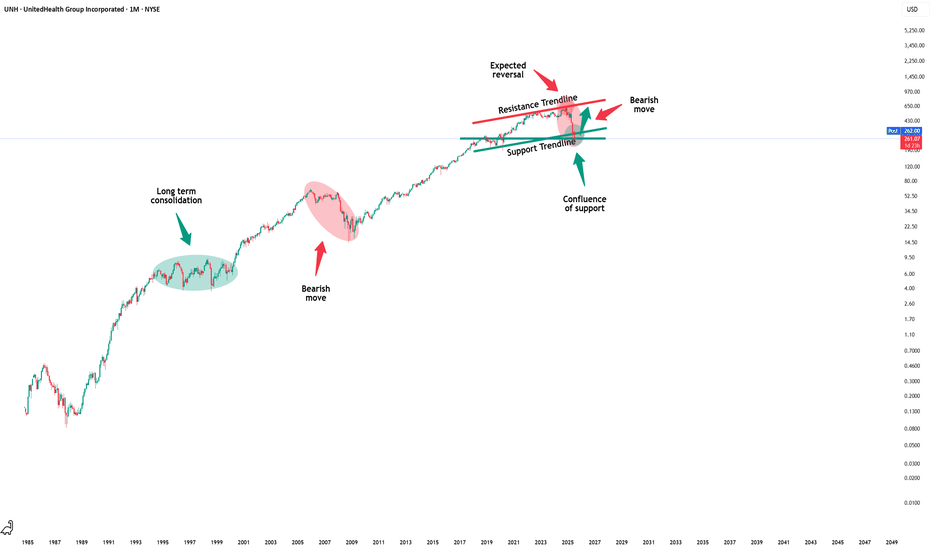

UnitedHealth: Deeply oversold but worth a closer lookUnitedHealth (UNH) is the largest private healthcare company in America. Eight million Medicare Advantage members. Optum’s network reaches tens of millions more. It has the data, the reach, and the pricing power. At today’s valuation, it’s worth adding to your watchlist. Forward P/E at 11× versus a

BTC Holding Strong: Fibonacci Levels Point to $130KBITSTAMP:BTCUSD is holding above a key dynamic support zone at the lower boundary of its ascending channel, with current price action signaling a potential continuation to the upside. This long setup is supported by multiple bullish confluences.

✅ Bullish Confluences:

Fibonacci Retracement Suppor

BITCOIN DAILY/4HR THE daily trendline and 4hr trendline break out will be watched for forward guidance.

if we break the top layer resistance we buy and target 123k current all time and high and factor the possibility of 135-130k-128k zone for next sell.

And our sell will be on break of steep ascending trendline a

See all editors' picks ideas

Dynamic Swing Anchored VWAP (Zeiierman)█ Overview

Dynamic Swing Anchored VWAP (Zeiierman) is a price–volume tool that anchors VWAP at fresh swing highs/lows and then adapts its responsiveness as conditions change. Instead of one static VWAP that drifts away over time, this indicator re-anchors at meaningful structure points (swings).

Trading Holidays and Expiry CalendarTrading Holiday and Expiry Calendar

This indicator displays calendar for current and next 2 months. Calendar marks ‘CRITICAL DAYS’ on the calendar.

‘CRITICAL DAYS’:

Trading Days

Trading Holidays

Weekends

Expiry Days

Out of these ‘Expiry Days’ are marked based on User input and rest of

Drawdown Distribution Analysis (DDA) ACADEMIC FOUNDATION AND RESEARCH BACKGROUND

The Drawdown Distribution Analysis indicator implements quantitative risk management principles, drawing upon decades of academic research in portfolio theory, behavioral finance, and statistical risk modeling. This tool provides risk assessment capabilit

FunctionADFLibrary "FunctionADF"

Augmented Dickey-Fuller test (ADF), The ADF test is a statistical method used to assess whether a time series is stationary – meaning its statistical properties (like mean and variance) do not change over time. A time series with a unit root is considered non-stationary and

Adaptive Market Profile – Auto Detect & Dynamic Activity ZonesAdaptive Market Profile is an advanced indicator that automatically detects and displays the most relevant trend channel and market profile for any asset and timeframe. Unlike standard regression channel tools, this script uses a fully adaptive approach to identify the optimal period, providing you

Trading Report Generator from CSVMany people use the Trading Panel. Unfortunately, it doesn't have a Performance Report. However, TradingView has strategies, and they have a Performance Report :-D

What if we combine the first and second? It's easy!

This script is a special strategy that parses transactions in csv format from Paper

Smart Money Breakout Channels [AlgoAlpha]🟠 OVERVIEW

This script draws breakout detection zones called “Smart Money Breakout Channels” based on volatility-normalized price movement and visualizes them as dynamic boxes with volume overlays. It identifies temporary accumulation or distribution ranges using a custom normalized volatility me

Trend Range Detector (Zeiierman)█ Overview

Trend Range Detector (Zeiierman) is a market structure tool that identifies and tracks periods of price compression by forming adaptive range boxes based on volatility and price movement. When prices remain stable within a defined band, the script dynamically draws a range box; when p

BE-Indicator Aggregator toolkit█ Overview:

BE-Indicator Aggregator toolkit is a toolkit which is built for those we rely on taking multi-confirmation from different indicators available with the traders. This Toolkit aid's traders in understanding their custom logic for their trade setups and provides the summarized results o

Synthetic VX3! & VX4! continuous /VX futuresTradingView is missing continuous 3rd and 4th month VIX (/VX) futures, so I decided to try to make a synthetic one that emulates what continuous maturity futures would look like. This is useful for backtesting/historical purposes as it enables traders to see how their further out VX contracts would'

See all indicators and strategies

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

Circle buying opportunity. Bullish chartWith the announcement of the new stock release, more selling should come. I see limit entries of 139 and 144 to be ideal. Overall pattern is 4th wave correction IMO. Target at least double top in short term and much higher long term. People smarter than me would put stop losses under those targ

BNC — The Wall Street Backdoor to BNBMost U.S. investors can’t buy BNB (the world’s #3 cryptocurrency) directly in their brokerage accounts. Yet it powers one of the most-used blockchains in the world => it is deflationary, pays yield, and has outperformed Bitcoin over the last five years.

But there’s now a backdoor … and it trades

ZM: Prepare not to miss this Long opportunityZM: Prepare not to miss this Long opportunity

Starting in early December 2022, I tested several strong support areas located near 60.50 - 64.50 that pushed the price higher compared to the past.

At the bottom of the structure, the ZM confirmed several times that buyers are well positioned near th

ARM – Cup & Handle Pattern with Potential BreakoutOn ARM’s daily chart, we can see a clear Cup & Handle pattern – twice in a row – with strong upward moves following each completion.

The latest pattern completed around the $165 area, after which the stock pulled back into a healthy correction and is now consolidating in the $140–$150 range.

Techni

JPM: Mean Reversion (FREMA)🏛️ Research Notes

Already looks mature to me

Conditional averaging of percentage change shows weakening bullish momentum

Testing FREMA as an indicator for mean reversion, where I will look for deviations from the average and anticipate a price movement back towards that mean. The band

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of su

NVDA cant stop wont stop! in my last updated I said watch the 144.80 level.. if we could get a clean daily close over that then 175-200 should follow! well my 175 target is smashed, we could dip to 170 short term but I expect my 200 target to get smashed in the next month ;)

congrats to all longs, see you soon.. boost and f

8/14/25 - $onon - lol. really? ez tiger8/14/25 :: VROCKSTAR :: NYSE:ONON

lol. really? ez tiger

- one analyst says he can see the future and growth is "only" the mid teens (lol - find any other footwear brand doing even this putz' bear case)

- 3% fcf yields growing big DD, already a buy

- the "comp" is nike which i haven't found anyone

See all stocks ideas

Aug 14

LYELLyell Immunopharma, Inc.

Actual

−3.67

USD

Estimate

−3.52

USD

Aug 14

BIRKBirkenstock Holding plc

Actual

0.73

USD

Estimate

0.70

USD

Aug 14

GLNGGolar LNG Limited

Actual

0.24

USD

Estimate

0.22

USD

Aug 14

XXII22nd Century Group, Inc

Actual

−13.16

USD

Estimate

−6.21

USD

Aug 14

RMTIRockwell Medical, Inc.

Actual

−0.05

USD

Estimate

−0.05

USD

Aug 14

AMCRAmcor plc

Actual

0.20

USD

Estimate

0.21

USD

Aug 14

DEDeere & Company

Actual

4.75

USD

Estimate

4.57

USD

Aug 14

AIROAIRO Group Holdings, Inc.

Actual

0.30

USD

Estimate

0.10

USD

See more events

News didn't load

Looks like that didn't go very well. Let's try again.

Community trends

Ether Soars in Massive Rally — Is Altcoin Season Finally Here?Bitcoin who? Move over, orange coin. It's the alt season and Ethereum and its crew of alternatives are here to party.

🚀 Ether Edges Toward All-Time High

Ethereum BITSTAMP:ETHUSD is all the game in crypto town right now. Prices climbed another 3% early Thursday, cruising past $4,750 and now ju

Ethereum's Last Wave? Bearish Trend Incoming!Ethereum ( BINANCE:ETHUSDT ) started to rise and pump as I expected in the previous idea .

Ethereum is currently trading in a Heavy Resistance zone($4,868(ATH)-$3,977) near the Potential Reversal Zone(PRZ) , Cumulative Short Liquidation Leverage($4,527-$4,452) , and the upper line of the

BITCOIN The vast importance of the Pivots. Is $180k possible?Bitcoin (BTCUSD) is most likely starting the new Bullish Leg of this Cycle, as stated on our recent analysis following the 1D MA50 (red trend-line) rebound.

Today we point out the critical role of Pivot trend-lines, which throughout the entirety of the current Bull Cycle, have provided a Support le

CLong

$BTC is repeating history, and it’s doing it with precision.CRYPTOCAP:BTC is repeating history, and it’s doing it with precision. 📈

In the last cycle, it took Bitcoin 1,044 days to move from the bear market bottom to a new all-time high. This cycle is on the same timeline, and we’re now well into that phase.

Price is staying inside the long-term rising ch

Bitcoin Resumes Bullish Momentum After CorrectionBitcoin Resumes Bullish Momentum After Correction

After reaching our initial target, BTC pulled back for a corrective move down to 118,000.

That bearish phase now appears to be complete near $118,000, with bullish momentum gaining strength once again.

Price action is currently breaking above ye

Ethereum - Here comes the final breakout!🚀Ethereum ( CRYPTO:ETHUSD ) breaks the all time high:

🔎Analysis summary:

Finally, after a consolidation of about four years, Ethereum is back at the previous all time high. With the recent rally of more than +200%, bulls are flexing their muscles, preparing the breakout. So far, everything is

Bitcoin soon above 123K again enter long near 0.61% Fib support The price can pump without touching our entry because market is gonna start next phase pump ASAP but we put our short-term signal on one of the major support which is 0.61 Fib retracement level and also trade is 1:3(Risk: Reward).

for long-term view and CRYPTOCAP:BTC target which is 137K$ in my m

Crypto Market - 1 month (30 days) left until #ALTSZN endsSometimes, the market forces you to take a pause. The last few weeks have been exactly that for me. Health issues knocked me off my game, and my first thought, of course, was that it was due to the nerves and immense responsibility of this public #AltsznLive experiment. But after some self-reflectio

Ethereum Breaks 504 Days Long Resistance · The 2025 Bull MarketEther just broke a 504 days long resistance. The next one is the 2021 all-time high which happened a massive 1,372 days ago. Early November 2021.

Ethereum is breaking all resistance. One is already gone and the next one will be gone very soon, just this week is the first time that ETHUSDT is moving

XRPUSDT Targets $4.17 After Neckline BreakXRPUSDT is forming a potential inverse head and shoulders structure, with price currently building the right shoulder above the key demand zone. A confirmed breakout above the neckline would validate the bullish reversal pattern, targeting the projected levels at $3.7094 and $4.1769. The plan is to

See all crypto ideas

News didn't load

Looks like that didn't go very well. Let's try again.

Lingrid | GOLD Key Support Zone In Range-Bound MarketOANDA:XAUUSD is approaching the confluence of the downward trendline and the 3,315 support, forming a potential bullish reversal setup. The structure suggests a base-building phase after the recent correction, aligning with the 61.8% golden zone of the prior swing. A decisive push above 3,340 would

GOLD NEXT MOVE (expecting a bearish move)(13-08-2025)Go through the analysis carefully and do trade accordingly.

Anup 'BIAS for the day (13-08-2025)

Current price- 3370

"if Price stays below 3382, then next target is 3360, 3350 and 3320 and and above that 3400 ".

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (

OShort

GOLD ROUTE MAP UPDATEHey Everyone,

We are still seeing price action within the retracement range. The full gap below at 3329 remains open from the previous cross-and-lock, and we now have another cross-and-lock confirming this.

We expect a bounce at this level unless we see a further cross-and-lock below 3329, which w

XAU/USD | Bull or Bear? Let's See! (READ THE CAPTION)By analyzing the #Gold chart on the 4-hour timeframe, we can see that after correcting down to the $3331 demand zone, price faced strong buying pressure and is now trading around $3357.

If gold manages to hold below $3367, we could expect a stronger drop, with downside targets at $3342, $3331, and

GOLD → Consolidation ahead of potential growth. PPI ahead...FX:XAUUSD is still consolidating, with the range expanding. The price has confirmed the formation of an upward price channel, which bulls are defending quite aggressively...

Gold remains in positive territory for the third day in a row and is consolidating above $3,350 in Asian trading, awaiti

FLong

Gold 30Min Engaged ( Bearish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish Reversal - 3348

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising benea

TShort

SILVER (XAGUSD): Bullish Rally is Going to ContinueSILVER remains in a strong bullish trend for quite a long time now.

The breach of a significant intraday resistance serves as another crucial bullish signal.

Given the strength of the bullish momentum, I believe the price will continue climbing,

with the next target set at 39.00.

XAUUSD - Precious Metal Regains MomentumHello everyone, what’s your view on OANDA:XAUUSD ?

Gold is reversing some of its previous losses and is moving within an upward price channel. The precious metal has climbed to $3,368, recovering more than $12 on the day. This marks a rebound in the global gold market after two consecutive sessio

OLong

XAGUSDHello Traders! 👋

What are your thoughts on Silver?

As shown on the chart, silver has broken its ascending trendline and already completed a retest (pullback) to the broken level. Currently, the price is trading below the key resistance zone and a descending trendline, indicating possible weakness

OShort

The Path to $200 Oil: A Storm and the T Pattern of the DecadeIn anticipation of the potential meeting between Trump and Putin, many are expecting de-escalation. My primary scenario, however, is that the initial talks will most likely fail. This event will not bring relief but will instead trigger a new round of escalation: intensified sanctions and, consequen

See all futures ideas

News didn't load

Looks like that didn't go very well. Let's try again.

EURUSD - Moving towards the upper boundary in the rising channelSince reaching its recent low on August 1st, EUR/USD has been moving within a clear and consistent rising channel on the 4-hour chart. This upward structure has been well respected, with price action repeatedly reacting to both the upper resistance and lower support boundaries. The overall trajector

EUR/NZD - Channel Breakout (14.08.2025) The EUR/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline

EURUSD – Climbing for Liquidity, Then What?EURUSD continues to move within a well-defined ascending channel, respecting both the upper and lower trendlines. After the recent rejection from the lower boundary, price found support inside a fair value gap, triggering a strong bullish reaction. This bounce has maintained the overall bullish stru

USDJPY 30Min Engaged ( Bullish Movement Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Movement From : 146.550

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is risi

"USDCHF Breakout from Descending Channel – Key Levels to Watch"USDCHF has been moving within a well-defined descending channel on the 4H timeframe since early May, forming a series of lower highs and lower lows. This pattern generally reflects a controlled downtrend where sellers remain in charge but within a structured range.

In the most recent price action,

Euro may reach seller zone and then start to decline to 1.1600Hello traders, I want share with you my opinion about Euro. The historical price action for the Euro began with a period of contracting volatility, where the market consolidated within a triangle formation. A decisive breakout from this triangle unleashed a strong upward impulse, which marked a shif

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

Price broke its ascending trendline and entered a corrective phase, retracing to the 50% and 61.8% Fibonacci levels .

Currently, the market is trading near a major resistance zone, which aligns with the 76.8% Fibonacci retracement, a supply area, t

GBPCAD: Pushing onto clear ResistanceWhat we’re looking at on GBPCAD is price getting close to a clear resistance, just the kind I love trading. That is because when there are strong upmoves like this one meeting with proper zones, it's when it can take a break and inverse short term.

If price gives us a confirmation as exhaustion or

GBPUSD: Structure AnalysisGBPUSD: Structure Analysis

GBPUSD reached a strong structural resistance area near 1.3590.

In two weeks, GBPUSD rose by almost +450 after the BOE cut interest rates.

However, GBPUSD also rose because the US is expected to cut rates after the BOE cut rates.

As we can see for the same news, the mar

See all forex ideas

| EUR | USD | GBP | JPY | CHF | AUD | CAD | ||

|---|---|---|---|---|---|---|---|---|

| EUR | - | - | - | - | - | - | - | |

| USD | - | - | - | - | - | - | - | |

| GBP | - | - | - | - | - | - | - | |

| JPY | - | - | - | - | - | - | - | |

| CHF | - | - | - | - | - | - | - | |

| AUD | - | - | - | - | - | - | - | |

| CNY | - | - | - | - | - | - | - | |

| CAD | - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.